|

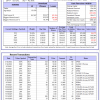

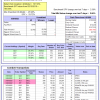

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

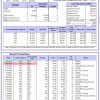

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -5.7%, and for the last 12 months is 7.5%. Over the same period the benchmark E60B40 performance was -4.7% and 7.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.15% at a time when SPY gained 1.35%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $153,605 which includes $694 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -6.1%, and for the last 12 months is 8.0%. Over the same period the benchmark E60B40 performance was -4.7% and 7.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.15% at a time when SPY gained 1.35%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $157,906 which includes $816 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -6.5%, and for the last 12 months is 8.5%. Over the same period the benchmark E60B40 performance was -4.7% and 7.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.15% at a time when SPY gained 1.35%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $162,025 which includes $879 cash and excludes $2,374 spent on fees and slippage. |

|

|

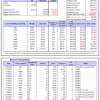

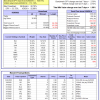

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 412.80% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 4.06% at a time when SPY gained 2.59%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $128,201 which includes -$1,952 cash and excludes $1,641 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 292.20% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 5.35% at a time when SPY gained 2.59%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $98,051 which includes $298 cash and excludes $1,052 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 546.07% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 4.16% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $646,066 which includes $1,147 cash and excludes $8,416 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 184.76% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 3.61% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $284,762 which includes $101 cash and excludes $7,874 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 288.32% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -1.14% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $388,325 which includes $61 cash and excludes $4,515 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 505.05% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.99% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $605,049 which includes $1,350 cash and excludes $1,706 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 167.92% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.74% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $267,924 which includes $1,590 cash and excludes $1,532 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 395.77% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -0.26% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $495,774 which includes $7,123 cash and excludes $6,641 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 129.62% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 3.51% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $229,622 which includes $333 cash and excludes $8,983 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 189.61% while the benchmark SPY gained 150.36% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -1.59% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $289,614 which includes $264 cash and excludes $4,199 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 27.46% while the benchmark SPY gained 29.96% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.07% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $127,459 which includes $2,787 cash and excludes $00 spent on fees and slippage. |

|

|

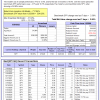

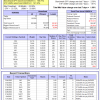

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 4.5%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 0.47% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $412,617 which includes $2,445 cash and excludes $7,640 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 19.9%, and for the last 12 months is 13.9%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 2.44% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$19,347 which includes $95,438 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 2.59% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $294,781 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -3.6%, and for the last 12 months is 16.6%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.58% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $820,294 which includes $2,847 cash and excludes $25,231 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -4.4%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 3.60% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $201,210 which includes -$121 cash and excludes $7,707 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -11.2%, and for the last 12 months is 9.4%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of iM-Combo5 gained 2.66% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $201,766 which includes -$1,296 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -5.8%, and for the last 12 months is 6.1%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Since inception, on 7/1/2014, the model gained 201.54% while the benchmark SPY gained 168.75% and VDIGX gained 151.10% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.08% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $301,542 which includes -$200 cash and excludes $4,274 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 5.9%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.27% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $222,558 which includes $2,705 cash and excludes $2,171 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 5.5%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Since inception, on 6/30/2014, the model gained 166.56% while the benchmark SPY gained 168.75% and the ETF USMV gained 141.32% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.66% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $266,556 which includes $1,549 cash and excludes $7,436 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 18.5%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Since inception, on 1/3/2013, the model gained 526.01% while the benchmark SPY gained 270.99% and the ETF USMV gained 270.99% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.99% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $626,012 which includes $1,590 cash and excludes $5,587 spent on fees and slippage. |

|

|

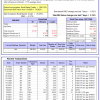

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -4.6%, and for the last 12 months is -2.8%. Over the same period the benchmark BND performance was -6.5% and -4.9% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.19% at a time when BND gained -0.52%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $144,981 which includes -$81 cash and excludes $2,203 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 2.59% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $294,781 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -2.8%, and for the last 12 months is 12.5%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.75% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,314 which includes $344 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -2.5%, and for the last 12 months is 13.7%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.05% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $164,246 which includes $89 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -3.7%, and for the last 12 months is 16.4%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.53% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $193,866 which includes $4,207 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 15.4%. Over the same period the benchmark SPY performance was -3.7% and 16.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.86% at a time when SPY gained 2.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $184,289 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.