|

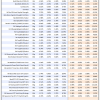

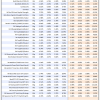

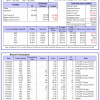

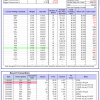

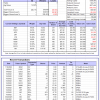

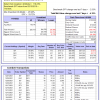

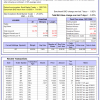

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

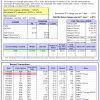

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -2.3%, and for the last 12 months is 13.9%. Over the same period the benchmark E60B40 performance was -1.8% and 12.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.50% at a time when SPY gained -1.86%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $159,137 which includes $1,351 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -2.3%, and for the last 12 months is 15.4%. Over the same period the benchmark E60B40 performance was -1.8% and 12.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -2.63% at a time when SPY gained -1.86%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $164,258 which includes $819 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -2.3%, and for the last 12 months is 16.8%. Over the same period the benchmark E60B40 performance was -1.8% and 12.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.75% at a time when SPY gained -1.86%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $169,231 which includes $517 cash and excludes $2,048 spent on fees and slippage. |

|

|

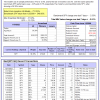

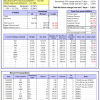

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 418.01% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -5.42% at a time when SPY gained -2.55%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $129,502 which includes $3,612 cash and excludes $1,565 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 339.77% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -6.15% at a time when SPY gained -2.55%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $109,943 which includes -$2 cash and excludes $985 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 585.67% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -5.60% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $685,667 which includes $796 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 141.69% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 1.59% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $241,687 which includes $3,184 cash and excludes $7,161 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 295.16% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 1.89% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $395,158 which includes $2,616 cash and excludes $4,141 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 537.01% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -2.42% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $637,010 which includes $3,059 cash and excludes $1,675 spent on fees and slippage. |

|

|

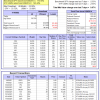

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 198.20% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.32% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $298,197 which includes $1,798 cash and excludes $1,529 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 405.68% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -0.35% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $505,677 which includes $9,675 cash and excludes $6,369 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 117.91% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.94% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $217,915 which includes $351 cash and excludes $8,367 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 238.52% while the benchmark SPY gained 154.84% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -4.25% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $338,516 which includes $633 cash and excludes $3,385 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 28.08% while the benchmark SPY gained 32.29% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.30% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $128,079 which includes $3,243 cash and excludes $00 spent on fees and slippage. |

|

|

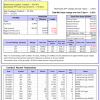

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 18.6%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.18% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $410,284 which includes $3,140 cash and excludes $7,395 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -9.0%, and for the last 12 months is 3.4%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -4.87% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$20,863 which includes $77,619 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 9.3%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.05% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $288,330 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

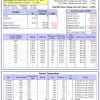

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 23.5%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.51% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $834,131 which includes $13,437 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -2.7%, and for the last 12 months is 16.7%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.92% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $204,778 which includes $6,604 cash and excludes $7,312 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 20.1%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of iM-Combo5 gained -4.19% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $218,401 which includes $2,597 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -2.6%, and for the last 12 months is 16.3%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Since inception, on 7/1/2014, the model gained 211.91% while the benchmark SPY gained 173.56% and VDIGX gained 147.28% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.02% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $311,910 which includes $1,271 cash and excludes $4,175 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.4%, and for the last 12 months is 16.4%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.51% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $220,413 which includes $2,496 cash and excludes $1,899 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 16.3%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Since inception, on 6/30/2014, the model gained 167.66% while the benchmark SPY gained 173.56% and the ETF USMV gained 143.44% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.97% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $267,658 which includes $1,765 cash and excludes $7,422 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 25.1%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Since inception, on 1/3/2013, the model gained 474.77% while the benchmark SPY gained 277.62% and the ETF USMV gained 277.62% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.85% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $574,770 which includes $4,031 cash and excludes $5,028 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 0.0%. Over the same period the benchmark BND performance was -1.5% and -2.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.07% at a time when BND gained -0.82%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $148,890 which includes $564 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 9.3%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.05% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $288,330 which includes $4,526 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.8%, and for the last 12 months is 16.6%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.44% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $152,928 which includes $4,209 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -1.7%, and for the last 12 months is 23.1%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.34% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $165,495 which includes $6,089 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 23.4%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -2.51% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $197,291 which includes $3,639 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -3.2%, and for the last 12 months is 6.8%. Over the same period the benchmark SPY performance was -2.0% and 23.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -3.76% at a time when SPY gained -2.55%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $172,977 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.