|

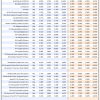

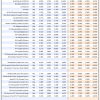

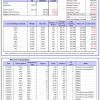

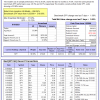

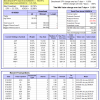

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 13.3%, and for the last 12 months is 24.0%. Over the same period the benchmark E60B40 performance was 11.5% and 19.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.60% at a time when SPY gained 0.82%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $156,304 which includes $1,313 cash and excludes $1,784 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 14.7%, and for the last 12 months is 27.0%. Over the same period the benchmark E60B40 performance was 11.5% and 19.9% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.61% at a time when SPY gained 0.82%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $160,817 which includes $883 cash and excludes $1,919 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 16.1%, and for the last 12 months is 29.9%. Over the same period the benchmark E60B40 performance was 11.5% and 19.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.62% at a time when SPY gained 0.82%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $165,219 which includes $859 cash and excludes $2,047 spent on fees and slippage. |

|

|

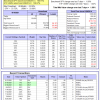

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 467.65% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -0.12% at a time when SPY gained 1.09%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $141,914 which includes $1,116 cash and excludes $1,417 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 432.70% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.97% at a time when SPY gained 1.09%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $133,175 which includes $319 cash and excludes $836 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 521.65% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -3.51% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $621,654 which includes $699 cash and excludes $7,786 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 136.60% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 4.31% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $236,596 which includes $282 cash and excludes $6,489 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 284.99% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 2.16% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $384,993 which includes $19 cash and excludes $3,628 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 493.06% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -0.38% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $593,058 which includes $2,704 cash and excludes $1,607 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 190.13% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 3.58% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $290,130 which includes $1,683 cash and excludes $1,391 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 387.85% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 2.11% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $487,848 which includes $915 cash and excludes $5,263 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 109.66% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.63% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $209,662 which includes $2,703 cash and excludes $7,691 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 232.99% while the benchmark SPY gained 143.06% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 6.08% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $332,995 which includes $1,075 cash and excludes $2,884 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 24.19% while the benchmark SPY gained 26.17% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.50% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $124,192 which includes $2,083 cash and excludes $00 spent on fees and slippage. |

|

|

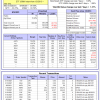

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 19.5%, and for the last 12 months is 41.3%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.25% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $404,444 which includes $1,158 cash and excludes $6,710 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 10.2%, and for the last 12 months is 31.2%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 3.91% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $01 which includes $66,124 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 15.7%, and for the last 12 months is 29.4%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.61% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $299,294 which includes $3,429 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 20.2%, and for the last 12 months is 34.3%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.08% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $796,042 which includes $8,034 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 13.5%, and for the last 12 months is 27.7%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.82% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $194,960 which includes $7,976 cash and excludes $7,039 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 19.8%, and for the last 12 months is 39.2%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of iM-Combo5 gained 0.74% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $212,843 which includes $1,883 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 15.4%, and for the last 12 months is 22.4%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Since inception, on 7/1/2014, the model gained 212.24% while the benchmark SPY gained 160.91% and VDIGX gained 145.74% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.12% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $312,239 which includes $1,289 cash and excludes $3,890 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 14.3%, and for the last 12 months is 25.3%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.40% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $214,962 which includes $1,865 cash and excludes $1,888 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 16.1%, and for the last 12 months is 22.7%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Since inception, on 6/30/2014, the model gained 160.51% while the benchmark SPY gained 160.91% and the ETF USMV gained 139.07% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.09% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $260,593 which includes -$2,588 cash and excludes $7,343 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 26.9%, and for the last 12 months is 49.0%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Since inception, on 1/3/2013, the model gained 472.73% while the benchmark SPY gained 260.16% and the ETF USMV gained 260.16% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.37% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $572,977 which includes $618 cash and excludes $4,816 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 10.1%. Over the same period the benchmark BND performance was -0.8% and 0.0% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.62% at a time when BND gained 0.42%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $154,620 which includes -$10 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 15.7%, and for the last 12 months is 29.4%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.61% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $299,294 which includes $3,429 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 12.0%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.77% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $146,951 which includes $2,781 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 17.4%, and for the last 12 months is 28.3%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.49% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $157,771 which includes $4,061 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 20.1%, and for the last 12 months is 34.0%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.08% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $188,303 which includes $2,364 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -1.0%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was 20.3% and 34.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.75% at a time when SPY gained 1.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $164,588 which includes -$2,224 cash and excludes $7,215 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.