|

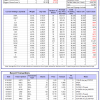

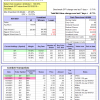

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 8.5%, and for the last 12 months is 22.6%. Over the same period the benchmark E60B40 performance was 7.0% and 21.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.65% at a time when SPY gained -0.41%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $149,690 which includes $350 cash and excludes $1,784 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 9.7%, and for the last 12 months is 25.3%. Over the same period the benchmark E60B40 performance was 7.0% and 21.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.67% at a time when SPY gained -0.41%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $153,750 which includes $25 cash and excludes $1,919 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 10.8%, and for the last 12 months is 28.1%. Over the same period the benchmark E60B40 performance was 7.0% and 21.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.69% at a time when SPY gained -0.41%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $157,715 which includes $113 cash and excludes $2,047 spent on fees and slippage. |

|

|

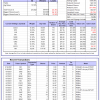

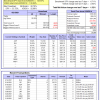

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 430.33% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -0.43% at a time when SPY gained -0.71%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $132,581 which includes -$825 cash and excludes $1,403 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 404.67% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 0.73% at a time when SPY gained -0.71%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $126,167 which includes $722 cash and excludes $812 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 499.11% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.93% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $599,108 which includes $3,301 cash and excludes $7,782 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 128.14% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -3.63% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $228,139 which includes $2,261 cash and excludes $6,209 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 274.34% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -1.94% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $374,342 which includes $2,369 cash and excludes $3,426 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 492.67% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -2.89% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $592,674 which includes $997 cash and excludes $1,607 spent on fees and slippage. |

|

|

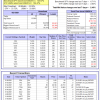

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 184.70% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.54% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $284,696 which includes -$419 cash and excludes $1,391 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 319.21% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.99% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $419,209 which includes $877 cash and excludes $5,263 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 92.55% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -2.10% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $192,550 which includes $649 cash and excludes $7,411 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 200.92% while the benchmark SPY gained 128.86% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -2.84% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $300,920 which includes $1,075 cash and excludes $2,884 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 19.76% while the benchmark SPY gained 18.80% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -2.35% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $119,762 which includes $1,997 cash and excludes $00 spent on fees and slippage. |

|

|

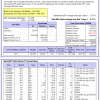

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 17.9%, and for the last 12 months is 54.5%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -3.11% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $399,206 which includes $1,861 cash and excludes $6,681 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 40.2%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -7.46% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $01 which includes $66,124 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 13.3%, and for the last 12 months is 40.6%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.07% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $293,042 which includes $3,044 cash and excludes $862 spent on fees and slippage. |

|

|

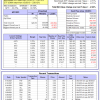

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 13.2%, and for the last 12 months is 38.8%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.71% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $750,010 which includes $8,034 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 7.7%, and for the last 12 months is 28.6%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.97% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $184,868 which includes $5,275 cash and excludes $7,036 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 12.8%, and for the last 12 months is 44.5%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of iM-Combo5 gained -0.71% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $200,383 which includes $4,379 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 8.2%, and for the last 12 months is 21.6%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Since inception, on 7/1/2014, the model gained 192.96% while the benchmark SPY gained 145.67% and VDIGX gained 130.84% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.32% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $292,965 which includes $928 cash and excludes $3,890 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 14.0%, and for the last 12 months is 52.4%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.43% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $214,472 which includes $38,777 cash and excludes $1,764 spent on fees and slippage. |

|

|

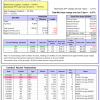

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 10.8%, and for the last 12 months is 21.4%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Since inception, on 6/30/2014, the model gained 148.59% while the benchmark SPY gained 145.67% and the ETF USMV gained 124.47% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.40% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $248,592 which includes $915 cash and excludes $7,328 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 19.9%, and for the last 12 months is 55.4%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Since inception, on 1/3/2013, the model gained 441.28% while the benchmark SPY gained 239.12% and the ETF USMV gained 239.12% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.92% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $541,276 which includes $2,858 cash and excludes $4,708 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 10.5%. Over the same period the benchmark BND performance was -2.1% and -0.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.07% at a time when BND gained 0.03%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $151,704 which includes $6,551 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 13.3%, and for the last 12 months is 40.6%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.07% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $293,042 which includes $3,044 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 5.7%, and for the last 12 months is 16.7%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.30% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $138,786 which includes $2,781 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.5%, and for the last 12 months is 29.3%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.93% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,228 which includes $3,584 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 13.2%, and for the last 12 months is 26.4%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.70% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $177,442 which includes $2,364 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 19.1%. Over the same period the benchmark SPY performance was 13.3% and 38.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -4.44% at a time when SPY gained -0.71%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $168,858 which includes $133 cash and excludes $6,883 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.