|

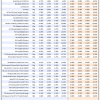

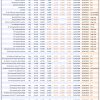

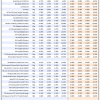

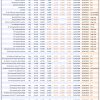

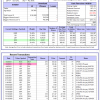

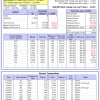

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 7.5%, and for the last 12 months is 23.9%. Over the same period the benchmark E60B40 performance was 6.0% and 28.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.00% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $148,357 which includes $1,606 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 26.7%. Over the same period the benchmark E60B40 performance was 6.0% and 28.0% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.06% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $152,330 which includes $1,475 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 29.4%. Over the same period the benchmark E60B40 performance was 6.0% and 28.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.12% at a time when SPY gained 0.03%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $156,209 which includes $1,631 cash and excludes $2,045 spent on fees and slippage. |

|

|

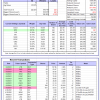

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 429.81% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -3.09% at a time when SPY gained 0.14%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $132,453 which includes -$4,773 cash and excludes $1,331 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 390.14% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -2.03% at a time when SPY gained 0.14%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $122,536 which includes $158 cash and excludes $750 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 482.30% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.44% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $582,300 which includes -$1,992 cash and excludes $7,247 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 121.94% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -2.44% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $221,939 which includes $20 cash and excludes $5,983 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 273.31% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -2.44% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $373,314 which includes $802 cash and excludes $3,426 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 450.88% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -2.44% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $550,881 which includes $4,109 cash and excludes $1,573 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 191.66% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 2.22% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $291,657 which includes $817 cash and excludes $1,257 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 298.82% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.44% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $398,823 which includes $1,096 cash and excludes $5,075 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 100.09% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -2.44% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $200,086 which includes $314 cash and excludes $7,041 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 219.94% while the benchmark SPY gained 126.67% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -2.44% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $319,937 which includes $2,079 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 18.50% while the benchmark SPY gained 17.66% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.87% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $118,503 which includes $1,749 cash and excludes $00 spent on fees and slippage. |

|

|

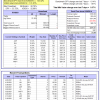

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 18.4%, and for the last 12 months is 78.7%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.35% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $400,856 which includes $1,535 cash and excludes $6,667 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 25.7%, and for the last 12 months is 54.7%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -3.07% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$2,106 which includes $66,121 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 45.4%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.14% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $290,012 which includes $3,127 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 38.3%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.14% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $742,895 which includes $5,608 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 34.7%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.81% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $182,050 which includes $533 cash and excludes $6,912 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 10.5%, and for the last 12 months is 53.9%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of iM-Combo5 gained -1.11% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $196,304 which includes $1,174 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 29.7%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Since inception, on 7/1/2014, the model gained 194.92% while the benchmark SPY gained 143.32% and VDIGX gained 131.87% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.37% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $294,921 which includes $347 cash and excludes $3,880 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 13.6%, and for the last 12 months is 64.3%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.99% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $213,681 which includes $2,223 cash and excludes $1,724 spent on fees and slippage. |

|

|

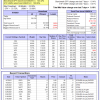

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 13.8%, and for the last 12 months is 34.8%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Since inception, on 6/30/2014, the model gained 155.31% while the benchmark SPY gained 143.32% and the ETF USMV gained 122.68% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.19% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $255,313 which includes $1,657 cash and excludes $7,285 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 21.3%, and for the last 12 months is 69.8%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Since inception, on 1/3/2013, the model gained 447.38% while the benchmark SPY gained 235.88% and the ETF USMV gained 235.88% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.04% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $547,384 which includes $117 cash and excludes $4,689 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 1.2%, and for the last 12 months is 15.9%. Over the same period the benchmark BND performance was -2.8% and -0.2% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.16% at a time when BND gained -0.13%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $150,527 which includes $6,069 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 45.4%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.14% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $290,012 which includes $3,127 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 5.7%, and for the last 12 months is 23.6%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.16% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $138,772 which includes $2,151 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.3%, and for the last 12 months is 39.0%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.13% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $150,964 which includes $3,152 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 25.1%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.14% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $175,763 which includes $1,792 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 26.4%. Over the same period the benchmark SPY performance was 12.2% and 50.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.58% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $169,756 which includes $734 cash and excludes $6,875 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.