|

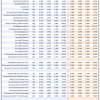

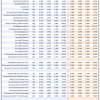

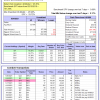

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

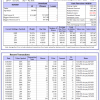

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 7.6%, and for the last 12 months is 23.1%. Over the same period the benchmark E60B40 performance was 6.2% and 24.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.51% at a time when SPY gained 0.63%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $148,539 which includes $69 cash and excludes $1,784 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 25.7%. Over the same period the benchmark E60B40 performance was 6.2% and 24.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.63% at a time when SPY gained 0.63%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $152,408 which includes $1,475 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 28.3%. Over the same period the benchmark E60B40 performance was 6.2% and 24.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.74% at a time when SPY gained 0.63%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $156,177 which includes $1,631 cash and excludes $2,045 spent on fees and slippage. |

|

|

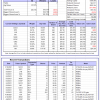

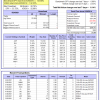

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 405.99% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.45% at a time when SPY gained 0.88%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $126,512 which includes -$853 cash and excludes $1,403 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 381.33% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 4.22% at a time when SPY gained 0.88%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $120,354 which includes $722 cash and excludes $812 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 502.87% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 5.43% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $602,865 which includes $2,836 cash and excludes $7,782 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 140.16% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.91% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $240,163 which includes $262 cash and excludes $6,104 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 282.98% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.62% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $382,979 which includes $1,579 cash and excludes $3,426 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 492.54% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 3.09% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $592,539 which includes $4,256 cash and excludes $1,573 spent on fees and slippage. |

|

|

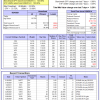

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 191.88% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.85% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $291,879 which includes -$646 cash and excludes $1,391 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 301.22% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.60% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $401,220 which includes $8,981 cash and excludes $5,252 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 99.50% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 1.32% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $199,500 which includes $1,102 cash and excludes $7,220 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 208.07% while the benchmark SPY gained 127.20% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -2.86% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $308,075 which includes $255 cash and excludes $2,760 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 21.64% while the benchmark SPY gained 17.94% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 2.18% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $121,641 which includes $1,401 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 21.6%, and for the last 12 months is 73.2%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.99% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $411,544 which includes $2,180 cash and excludes $6,667 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 19.7%, and for the last 12 months is 42.5%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -5.45% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $01 which includes $66,124 cash and excludes Gain to date spent on fees and slippage. |

|

|

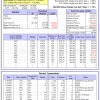

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 42.1%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.88% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $290,704 which includes $2,846 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 45.0%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.87% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $744,605 which includes $5,608 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 34.8%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.70% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $182,032 which includes $3,021 cash and excludes $6,914 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 10.0%, and for the last 12 months is 51.6%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of iM-Combo5 gained 2.17% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $235,777 which includes $1,429 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 10.3%, and for the last 12 months is 31.4%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Since inception, on 7/1/2014, the model gained 198.54% while the benchmark SPY gained 143.88% and VDIGX gained 132.25% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.14% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $298,543 which includes $939 cash and excludes $3,880 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 15.4%, and for the last 12 months is 62.1%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.54% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $216,969 which includes $37,625 cash and excludes $1,764 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 13.4%, and for the last 12 months is 30.3%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Since inception, on 6/30/2014, the model gained 154.31% while the benchmark SPY gained 143.88% and the ETF USMV gained 123.66% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.26% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $254,308 which includes $1,889 cash and excludes $7,285 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 24.3%, and for the last 12 months is 66.4%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Since inception, on 1/3/2013, the model gained 460.93% while the benchmark SPY gained 236.66% and the ETF USMV gained 236.66% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.10% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $560,931 which includes $629 cash and excludes $4,708 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 12.3%. Over the same period the benchmark BND performance was -2.7% and -0.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.18% at a time when BND gained 0.26%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $150,576 which includes $6,069 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 42.1%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.88% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $290,704 which includes $2,846 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 6.7%, and for the last 12 months is 20.1%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.54% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,115 which includes $2,151 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.8%, and for the last 12 months is 35.7%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.68% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,559 which includes $3,152 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 25.2%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.87% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $176,166 which includes $1,792 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 7.3%, and for the last 12 months is 28.6%. Over the same period the benchmark SPY performance was 12.5% and 44.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.92% at a time when SPY gained 0.88%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $178,365 which includes $734 cash and excludes $6,875 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.