|

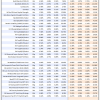

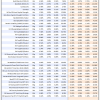

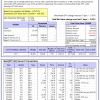

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

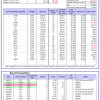

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 24.5%. Over the same period the benchmark E60B40 performance was 3.9% and 36.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.87% at a time when SPY gained 1.69%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $144,973 which includes $1,399 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 6.1%, and for the last 12 months is 27.2%. Over the same period the benchmark E60B40 performance was 3.9% and 36.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 2.17% at a time when SPY gained 1.69%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $148,714 which includes $1,319 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 29.8%. Over the same period the benchmark E60B40 performance was 3.9% and 36.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 2.45% at a time when SPY gained 1.69%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $152,368 which includes $1,527 cash and excludes $2,045 spent on fees and slippage. |

|

|

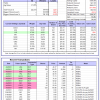

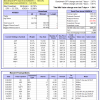

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 424.19% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 4.81% at a time when SPY gained 2.67%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $131,055 which includes -$4,804 cash and excludes $1,331 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 384.95% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 5.70% at a time when SPY gained 2.67%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $121,237 which includes $158 cash and excludes $750 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 510.63% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 4.58% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $610,633 which includes $7,992 cash and excludes $6,718 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 107.56% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 4.58% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $207,564 which includes $821 cash and excludes $5,696 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 264.46% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 4.58% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $364,462 which includes $1,583 cash and excludes $3,273 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 457.21% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 4.58% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $557,210 which includes $3,408 cash and excludes $1,573 spent on fees and slippage. |

|

|

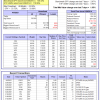

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 176.49% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.52% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $276,485 which includes $1,196 cash and excludes $1,242 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 290.72% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 4.58% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $390,724 which includes $3,086 cash and excludes $5,042 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 95.38% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 4.58% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $195,384 which includes $4,061 cash and excludes $7,036 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 212.66% while the benchmark SPY gained 120.25% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 4.58% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $312,656 which includes $2,079 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 16.62% while the benchmark SPY gained 14.33% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.87% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $116,622 which includes $1,608 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 17.1%, and for the last 12 months is 111.7%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.40% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $396,297 which includes $3,081 cash and excludes $6,553 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 24.2%, and for the last 12 months is 97.7%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 6.53% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $74,829 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

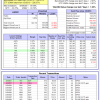

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 42.9%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 2.64% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $281,890 which includes $3,127 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 13.8%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.65% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $722,021 which includes $5,608 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is 30.7%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.38% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $177,818 which includes $4,344 cash and excludes $6,796 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 7.7%, and for the last 12 months is 52.2%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of iM-Combo5 gained 3.93% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $191,333 which includes $3,264 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 6.9%, and for the last 12 months is 41.1%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Since inception, on 7/1/2014, the model gained 189.23% while the benchmark SPY gained 136.43% and VDIGX gained 122.53% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.54% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $289,229 which includes $838 cash and excludes $3,880 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 11.8%, and for the last 12 months is 79.7%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.39% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $210,196 which includes $1,561 cash and excludes $1,637 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 13.7%, and for the last 12 months is 40.7%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Since inception, on 6/30/2014, the model gained 154.93% while the benchmark SPY gained 136.43% and the ETF USMV gained 116.99% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.05% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $254,927 which includes $1,562 cash and excludes $7,285 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 18.8%, and for the last 12 months is 90.2%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Since inception, on 1/3/2013, the model gained 436.02% while the benchmark SPY gained 226.37% and the ETF USMV gained 226.37% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.26% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $536,023 which includes $68 cash and excludes $4,573 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 15.6%. Over the same period the benchmark BND performance was -3.5% and 0.8% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.48% at a time when BND gained 0.23%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $149,924 which includes $5,582 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 42.9%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 2.64% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $281,890 which includes $3,127 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 3.4%, and for the last 12 months is 31.8%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.17% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $135,754 which includes $2,151 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 47.8%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.07% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $146,117 which includes $3,152 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 21.5%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.64% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $170,837 which includes $1,792 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -1.5%, and for the last 12 months is 29.0%. Over the same period the benchmark SPY performance was 9.0% and 66.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 2.86% at a time when SPY gained 2.67%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $163,715 which includes $2,454 cash and excludes $6,719 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.