|

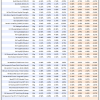

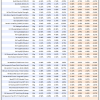

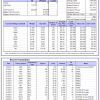

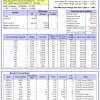

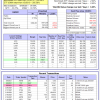

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

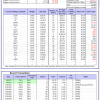

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 10.6%. Over the same period the benchmark E60B40 performance was -0.2% and 18.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.94% at a time when SPY gained -1.67%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $139,030 which includes $983 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 1.2%, and for the last 12 months is 11.7%. Over the same period the benchmark E60B40 performance was -0.2% and 18.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -2.12% at a time when SPY gained -1.67%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $141,904 which includes $881 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 12.7%. Over the same period the benchmark E60B40 performance was -0.2% and 18.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.30% at a time when SPY gained -1.67%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $144,693 which includes $1,068 cash and excludes $2,045 spent on fees and slippage. |

|

|

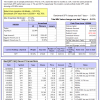

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 393.76% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -8.12% at a time when SPY gained -2.02%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $123,439 which includes -$2,284 cash and excludes $1,325 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 345.59% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -8.44% at a time when SPY gained -2.02%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $111,398 which includes $122 cash and excludes $745 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 404.94% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.11% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $504,935 which includes $2,295 cash and excludes $6,231 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 100.24% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -2.11% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $200,241 which includes $531 cash and excludes $5,514 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 244.59% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -2.11% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $344,592 which includes $1,220 cash and excludes $3,273 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 393.60% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -2.11% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $493,595 which includes $2,355 cash and excludes $1,573 spent on fees and slippage. |

|

|

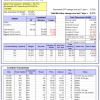

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 155.86% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.91% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $255,864 which includes $475 cash and excludes $1,242 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 264.76% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.11% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $364,764 which includes $2,311 cash and excludes $5,042 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 86.79% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -2.11% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $186,791 which includes $779 cash and excludes $6,948 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 169.98% while the benchmark SPY gained 106.22% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -2.11% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $269,978 which includes $1,433 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 8.01% while the benchmark SPY gained 7.05% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.75% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $108,008 which includes $2,016 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 9.5%, and for the last 12 months is 67.0%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.65% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $371,111 which includes $862 cash and excludes $6,451 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 15.0%, and for the last 12 months is 65.1%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -2.97% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $07 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

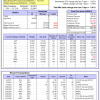

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 28.5%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -2.00% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $264,110 which includes $2,250 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 3.3%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.01% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $676,328 which includes $3,355 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -1.5%, and for the last 12 months is 4.0%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained -3.24% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $169,129 which includes $6,389 cash and excludes $6,793 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 22.0%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of iM-Combo5 gained -2.37% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $180,211 which includes $40,188 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -1.8%, and for the last 12 months is 17.2%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Since inception, on 7/1/2014, the model gained 165.90% while the benchmark SPY gained 121.37% and VDIGX gained 70.08% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.01% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $265,900 which includes $1,060 cash and excludes $3,872 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.2%, and for the last 12 months is 23.8%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.95% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $190,390 which includes $133 cash and excludes $1,637 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 6.6%, and for the last 12 months is 8.5%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Since inception, on 6/30/2014, the model gained 139.04% while the benchmark SPY gained 121.37% and the ETF USMV gained 104.84% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 3.49% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $239,100 which includes $517 cash and excludes $7,197 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 9.4%, and for the last 12 months is 41.9%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Since inception, on 1/3/2013, the model gained 393.69% while the benchmark SPY gained 205.58% and the ETF USMV gained 205.58% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 3.85% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $493,865 which includes $493 cash and excludes $3,765 spent on fees and slippage. |

|

|

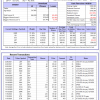

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -0.8%, and for the last 12 months is -2.8%. Over the same period the benchmark BND performance was -3.7% and -1.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.23% at a time when BND gained -1.16%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $147,581 which includes $5,096 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 28.5%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -2.00% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $264,110 which includes $2,250 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -2.6%, and for the last 12 months is 4.0%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.75% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $127,903 which includes $1,546 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 11.9%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.17% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $137,921 which includes $2,385 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 5.9%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -2.00% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,056 which includes $1,260 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -9.8%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was 2.1% and 30.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.38% at a time when SPY gained -2.02%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $149,990 which includes -$4,971 cash and excludes $6,239 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.