|

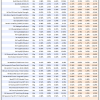

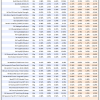

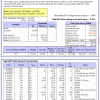

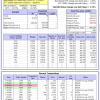

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

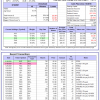

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 6.7%. Over the same period the benchmark E60B40 performance was 2.2% and 13.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.14% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $143,262 which includes $983 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 4.5%, and for the last 12 months is 6.1%. Over the same period the benchmark E60B40 performance was 2.2% and 13.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.25% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $146,452 which includes $881 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 5.1%, and for the last 12 months is 5.6%. Over the same period the benchmark E60B40 performance was 2.2% and 13.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.36% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $149,551 which includes $1,068 cash and excludes $2,045 spent on fees and slippage. |

|

|

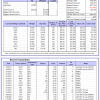

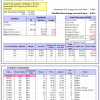

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 440.37% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -0.75% at a time when SPY gained 0.46%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $135,109 which includes $4,978 cash and excludes $1,219 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 417.18% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 2.21% at a time when SPY gained 0.46%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $129,319 which includes $136 cash and excludes $718 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 462.60% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 1.81% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $562,603 which includes $1,748 cash and excludes $6,231 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 90.92% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 1.81% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $190,921 which includes $14 cash and excludes $5,498 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 219.08% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 1.81% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $319,084 which includes $1,400 cash and excludes $3,244 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 413.14% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.81% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $513,137 which includes $1,758 cash and excludes $1,573 spent on fees and slippage. |

|

|

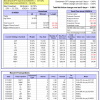

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 153.36% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -3.54% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $253,360 which includes $314 cash and excludes $1,242 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 291.75% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.81% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $391,745 which includes $2,311 cash and excludes $5,042 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 86.16% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 1.81% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $186,155 which includes $874 cash and excludes $6,701 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 188.15% while the benchmark SPY gained 111.94% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 1.81% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $288,153 which includes $1,068 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 8.09% while the benchmark SPY gained 10.02% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.59% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $108,094 which includes $886 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 7.5%, and for the last 12 months is 43.7%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.41% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $364,059 which includes $279 cash and excludes $6,198 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 18.6%, and for the last 12 months is 76.9%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 9.15% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $07 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 34.6%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.45% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $271,368 which includes $2,250 cash and excludes $773 spent on fees and slippage. |

|

|

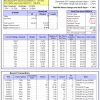

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is -6.5%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.46% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $694,980 which includes $3,355 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is -5.8%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.23% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $177,151 which includes $6,355 cash and excludes $6,793 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of iM-Combo5 gained 0.49% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $186,352 which includes $40,167 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -1.1%, and for the last 12 months is 6.8%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Since inception, on 7/1/2014, the model gained 167.58% while the benchmark SPY gained 127.50% and VDIGX gained 68.95% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.69% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $267,647 which includes $441 cash and excludes $3,812 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 8.9%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.62% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $190,040 which includes $133 cash and excludes $1,637 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is -5.9%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Since inception, on 6/30/2014, the model gained 127.80% while the benchmark SPY gained 127.50% and the ETF USMV gained 106.96% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.14% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $227,862 which includes $265 cash and excludes $7,197 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 19.8%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Since inception, on 1/3/2013, the model gained 361.44% while the benchmark SPY gained 214.05% and the ETF USMV gained 168.91% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.72% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $461,590 which includes $385 cash and excludes $3,649 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 0.7%, and for the last 12 months is -1.9%. Over the same period the benchmark BND performance was -1.8% and 3.8% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.15% at a time when BND gained -0.72%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $149,807 which includes $4,587 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 34.6%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.45% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $271,368 which includes $2,250 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is -1.7%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.69% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,129 which includes $1,546 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 2.4%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.02% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $137,944 which includes $2,385 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is -3.9%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.45% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $164,457 which includes $1,260 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -5.2%, and for the last 12 months is 17.4%. Over the same period the benchmark SPY performance was 4.9% and 18.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.79% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $157,603 which includes $13,893 cash and excludes $5,950 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.