|

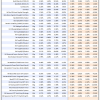

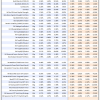

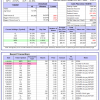

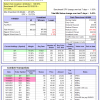

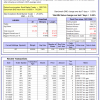

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

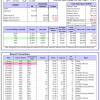

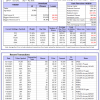

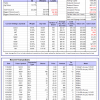

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 18.1%, and for the last 12 months is 25.6%. Over the same period the benchmark E60B40 performance was 14.8% and 20.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.83% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $163,038 which includes $558 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 20.1%, and for the last 12 months is 28.5%. Over the same period the benchmark E60B40 performance was 14.8% and 20.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.87% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $168,364 which includes $55 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 22.0%, and for the last 12 months is 31.3%. Over the same period the benchmark E60B40 performance was 14.8% and 20.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.89% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $173,529 which includes $1,601 cash and excludes $2,047 spent on fees and slippage. |

|

|

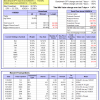

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 498.82% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.10% at a time when SPY gained 1.93%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $149,705 which includes $912 cash and excludes $1,511 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 425.56% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -3.79% at a time when SPY gained 1.93%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $131,391 which includes $1,024 cash and excludes $911 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 562.44% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 5.68% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $662,440 which includes $388 cash and excludes $8,335 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 135.10% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 5.72% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $235,105 which includes -$1,568 cash and excludes $6,821 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 282.66% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 2.03% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $382,656 which includes $6,640 cash and excludes $3,955 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 509.50% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 3.18% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $609,496 which includes $1,833 cash and excludes $1,638 spent on fees and slippage. |

|

|

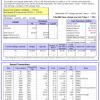

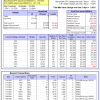

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 185.32% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.03% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $285,316 which includes $764 cash and excludes $1,512 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 361.38% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -0.26% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $461,382 which includes $1,857 cash and excludes $5,880 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 105.30% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.97% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $205,299 which includes -$28 cash and excludes $8,073 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 254.72% while the benchmark SPY gained 155.81% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 2.17% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $354,973 which includes $305 cash and excludes $3,209 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 24.99% while the benchmark SPY gained 32.79% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 2.36% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $125,013 which includes $928 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 17.0%, and for the last 12 months is 33.1%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.93% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $396,932 which includes $1,677 cash and excludes $7,106 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 2.8%, and for the last 12 months is 12.7%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 1.35% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $06 which includes $73,732 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 13.7%, and for the last 12 months is 21.9%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.58% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $294,137 which includes $4,038 cash and excludes $862 spent on fees and slippage. |

|

|

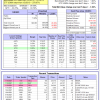

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 26.4%, and for the last 12 months is 35.5%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.91% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $837,275 which includes $10,552 cash and excludes $25,118 spent on fees and slippage. |

|

|

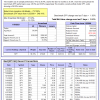

iM-Combo3.R1: The model’s out of sample performance YTD is 21.4%, and for the last 12 months is 31.1%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained 3.26% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $208,465 which includes $3,258 cash and excludes $7,171 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 28.9%, and for the last 12 months is 40.3%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of iM-Combo5 gained 3.42% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $228,958 which includes $1,465 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 14.5%, and for the last 12 months is 20.3%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Since inception, on 7/1/2014, the model gained 209.84% while the benchmark SPY gained 174.60% and VDIGX gained 153.42% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.47% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $309,956 which includes $339 cash and excludes $4,139 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 10.2%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.28% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $207,284 which includes $729 cash and excludes $1,899 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 13.9%, and for the last 12 months is 23.2%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Since inception, on 6/30/2014, the model gained 155.54% while the benchmark SPY gained 174.60% and the ETF USMV gained 141.11% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.52% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $255,537 which includes $100 cash and excludes $7,381 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 23.3%, and for the last 12 months is 39.0%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Since inception, on 1/3/2013, the model gained 456.72% while the benchmark SPY gained 279.07% and the ETF USMV gained 279.07% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.52% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $556,723 which includes $1,523 cash and excludes $5,028 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 5.4%. Over the same period the benchmark BND performance was -1.3% and -0.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.58% at a time when BND gained 0.55%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $151,925 which includes $309 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 13.7%, and for the last 12 months is 21.9%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.58% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $294,137 which includes $4,038 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 17.6%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.95% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,504 which includes $3,479 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 19.1%, and for the last 12 months is 26.1%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.61% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,044 which includes $4,954 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 26.3%, and for the last 12 months is 35.4%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.90% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $198,033 which includes $2,958 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 8.6%. Over the same period the benchmark SPY performance was 26.6% and 35.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.75% at a time when SPY gained 1.93%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $170,235 which includes $475 cash and excludes $7,877 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.