|

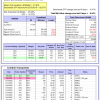

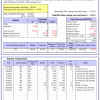

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -3.4%, and for the last 12 months is 1.1%. Over the same period the benchmark E60B40 performance was 6.8% and 12.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -3.16% at a time when SPY gained -2.74%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $125,009 which includes -$17 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -5.5%, and for the last 12 months is -0.2%. Over the same period the benchmark E60B40 performance was 6.8% and 12.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -3.60% at a time when SPY gained -2.74%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $125,310 which includes -$142 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -7.5%, and for the last 12 months is -1.6%. Over the same period the benchmark E60B40 performance was 6.8% and 12.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -4.04% at a time when SPY gained -2.74%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $125,524 which includes $25 cash and excludes $2,045 spent on fees and slippage. |

|

|

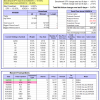

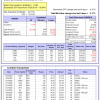

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 325.05% while the benchmark SPY gained 78.54% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -6.53% at a time when SPY gained -4.61%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $106,263 which includes $7,455 cash and excludes $1,082 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 14.4%, and for the last 12 months is 23.7%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.26% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $288,194 which includes $595 cash and excludes $5,490 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 47.5%, and for the last 12 months is 111.3%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 2.27% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $244 which includes $59,265 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -17.3%, and for the last 12 months is -9.8%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of Best(SPY-SH) gained -4.83% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $585,841 which includes -$29,265 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -14.6%, and for the last 12 months is -11.3%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of iM-Combo3.R1 gained -3.50% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $151,291 which includes $3,287 cash and excludes $6,568 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -1.8%, and for the last 12 months is 4.1%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of iM-Combo5 gained -6.54% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $151,363 which includes $2,966 cash and excludes $0 spent on fees and slippage. |

|

|

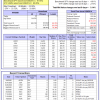

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 12.3%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Since inception, on 7/1/2014, the model gained 150.98% while the benchmark SPY gained 91.65% and VDIGX gained 86.80% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -3.17% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $250,984 which includes $729 cash and excludes $3,635 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -4.5%, and for the last 12 months is 8.8%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -3.18% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $169,613 which includes $1,139 cash and excludes $1,396 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -11.1%, and for the last 12 months is -0.2%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Since inception, on 6/30/2014, the model gained 108.73% while the benchmark SPY gained 91.65% and the ETF USMV gained 92.28% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -3.14% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $208,784 which includes $1,137 cash and excludes $7,084 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 4.2%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Since inception, on 1/3/2013, the model gained 278.07% while the benchmark SPY gained 164.56% and the ETF USMV gained 149.81% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.62% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $378,198 which includes $4,327 cash and excludes $3,495 spent on fees and slippage. |

|

|

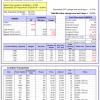

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -35.5%, and for the last 12 months is -31.4%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.78% at a time when BND gained 0.06%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $140,933 which includes $1,712 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -7.7%, and for the last 12 months is -10.5%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of iM-Best(Short) gained 0.06% at a time when SPY gained -4.61%. Over the period 1/2/2009 to 9/8/2020 the starting capital of $100,000 would have grown to $74,280 which includes $103,497 cash and excludes $28,478 spent on fees and slippage. |

|

|

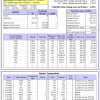

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -2.8%, and for the last 12 months is 0.4%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.46% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $122,258 which includes $57 cash and excludes $1,385 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -6.1%, and for the last 12 months is -2.8%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.35% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $121,776 which includes $271 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -18.8%, and for the last 12 months is -12.2%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -2.29% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,577 which includes $3,624 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -15.1%, and for the last 12 months is -10.4%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -4.61% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $138,661 which includes $46 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 12.7%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.82% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $146,745 which includes $3,179 cash and excludes $5,486 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -11.0%, and for the last 12 months is -7.1%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -1.09% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $100,186 which includes -$433 cash and excludes $2,017 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -35.5%, and for the last 12 months is -31.4%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -3.17% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $101,441 which includes -$305 cash and excludes $4,498 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -21.5%, and for the last 12 months is -16.4%. Over the same period the benchmark SPY performance was 4.6% and 14.0% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -1.91% at a time when SPY gained -4.61%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $106,557 which includes -$570 cash and excludes $4,241 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.