|

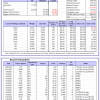

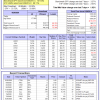

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 4.9%. Over the same period the benchmark E60B40 performance was 10.0% and 18.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 2.02% at a time when SPY gained 1.69%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $129,031 which includes -$17 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 4.0%. Over the same period the benchmark E60B40 performance was 10.0% and 18.0% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 2.31% at a time when SPY gained 1.69%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $130,021 which includes -$142 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -3.6%, and for the last 12 months is 3.1%. Over the same period the benchmark E60B40 performance was 10.0% and 18.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 2.59% at a time when SPY gained 1.69%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $130,924 which includes $25 cash and excludes $2,045 spent on fees and slippage. |

|

|

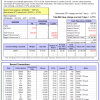

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 354.12% while the benchmark SPY gained 87.84% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.70% at a time when SPY gained 3.27%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $113,530 which includes $7,432 cash and excludes $1,082 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 16.9%, and for the last 12 months is 34.7%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 4.42% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $294,442 which includes $3,174 cash and excludes $5,390 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 45.4%, and for the last 12 months is 84.5%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 6.77% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$56 which includes $59,265 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -12.8%, and for the last 12 months is -1.1%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of Best(SPY-SH) gained 3.43% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $617,906 which includes -$29,265 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -11.2%, and for the last 12 months is -4.2%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.31% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $157,165 which includes -$1,865 cash and excludes $6,568 spent on fees and slippage. |

|

|

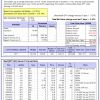

iM-Combo5: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 16.4%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of iM-Combo5 gained 3.65% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $161,671 which includes -$609 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 6.8%, and for the last 12 months is 19.9%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Since inception, on 7/1/2014, the model gained 161.30% while the benchmark SPY gained 101.64% and VDIGX gained 92.04% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.68% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $261,299 which includes $874 cash and excludes $3,631 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -1.1%, and for the last 12 months is 18.1%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.14% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $175,739 which includes $1,139 cash and excludes $1,396 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -8.1%, and for the last 12 months is 6.6%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Since inception, on 6/30/2014, the model gained 115.91% while the benchmark SPY gained 101.64% and the ETF USMV gained 98.11% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.92% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $215,913 which includes $1,029 cash and excludes $7,084 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 7.7%, and for the last 12 months is 11.7%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Since inception, on 1/3/2013, the model gained 292.39% while the benchmark SPY gained 178.34% and the ETF USMV gained 157.38% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 3.20% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $392,389 which includes $3,390 cash and excludes $3,495 spent on fees and slippage. |

|

|

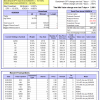

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -32.7%, and for the last 12 months is -26.9%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.48% at a time when BND gained -0.64%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $142,241 which includes $1,148 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -7.9%, and for the last 12 months is -9.5%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of iM-Best(Short) gained -1.30% at a time when SPY gained 3.27%. Over the period 1/2/2009 to 8/28/2020 the starting capital of $100,000 would have grown to $74,096 which includes $74,096 cash and excludes $28,447 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 5.6%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 2.16% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $125,648 which includes -$207 cash and excludes $1,384 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.3%, and for the last 12 months is 1.7%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.27% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,203 which includes $362 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -16.2%, and for the last 12 months is -5.4%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 2.75% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $128,546 which includes $3,624 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -10.7%, and for the last 12 months is -6.2%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 3.27% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $145,887 which includes $46 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 13.3%, and for the last 12 months is 17.7%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.07% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,398 which includes $72 cash and excludes $5,337 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -9.6%, and for the last 12 months is -4.4%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.86% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $101,821 which includes -$506 cash and excludes $2,017 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -32.7%, and for the last 12 months is -26.9%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 2.11% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $105,850 which includes -$305 cash and excludes $4,498 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -19.4%, and for the last 12 months is -12.7%. Over the same period the benchmark SPY performance was 10.0% and 24.6% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.70% at a time when SPY gained 3.27%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $109,491 which includes -$570 cash and excludes $4,241 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.