|

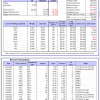

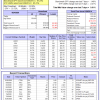

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

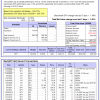

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -1.7%, and for the last 12 months is 4.0%. Over the same period the benchmark E60B40 performance was 8.7% and 17.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.99% at a time when SPY gained 0.98%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $127,306 which includes -$17 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -3.5%, and for the last 12 months is 2.9%. Over the same period the benchmark E60B40 performance was 8.7% and 17.3% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.06% at a time when SPY gained 0.98%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $128,018 which includes -$142 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -5.3%, and for the last 12 months is 1.8%. Over the same period the benchmark E60B40 performance was 8.7% and 17.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.12% at a time when SPY gained 0.98%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $128,643 which includes $25 cash and excludes $2,045 spent on fees and slippage. |

|

|

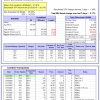

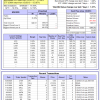

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 341.27% while the benchmark SPY gained 83.74% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.00% at a time when SPY gained 1.48%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $110,317 which includes $7,432 cash and excludes $1,082 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 14.3%, and for the last 12 months is 31.9%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.07% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $288,053 which includes $2,700 cash and excludes $5,390 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 36.9%, and for the last 12 months is 81.1%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -10.03% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $33,076 which includes $59,206 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -14.8%, and for the last 12 months is -2.7%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.56% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $603,765 which includes -$29,265 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -12.6%, and for the last 12 months is -4.7%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.02% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $154,737 which includes -$1,601 cash and excludes $6,561 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 14.8%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of iM-Combo5 gained 2.17% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $157,383 which includes -$1,220 cash and excludes $0 spent on fees and slippage. |

|

|

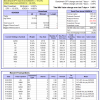

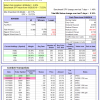

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 19.2%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Since inception, on 7/1/2014, the model gained 156.91% while the benchmark SPY gained 97.23% and VDIGX gained 88.50% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.40% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $256,914 which includes $764 cash and excludes $3,631 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -2.1%, and for the last 12 months is 15.1%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.90% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $173,999 which includes $1,139 cash and excludes $1,396 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -9.0%, and for the last 12 months is 5.0%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Since inception, on 6/30/2014, the model gained 113.70% while the benchmark SPY gained 97.23% and the ETF USMV gained 95.41% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.61% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $213,696 which includes $1,029 cash and excludes $7,084 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 6.6%, and for the last 12 months is 11.9%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Since inception, on 1/3/2013, the model gained 288.36% while the benchmark SPY gained 172.26% and the ETF USMV gained 153.87% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.27% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $388,362 which includes $3,390 cash and excludes $3,495 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -33.6%, and for the last 12 months is -27.5%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.64% at a time when BND gained 0.24%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $142,208 which includes $1,148 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -7.6%, and for the last 12 months is -8.8%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of iM-Best(Short) gained -1.72% at a time when SPY gained 1.48%. Over the period 1/2/2009 to 8/24/2020 the starting capital of $100,000 would have grown to $74,334 which includes $89,760 cash and excludes $28,430 spent on fees and slippage. |

|

|

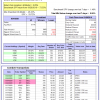

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.5%, and for the last 12 months is 5.1%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.15% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $123,909 which includes -$207 cash and excludes $1,384 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.9%, and for the last 12 months is 1.7%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.01% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $123,441 which includes $547 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -17.1%, and for the last 12 months is -6.1%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.01% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $127,101 which includes $3,624 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -12.6%, and for the last 12 months is -8.0%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.48% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $142,700 which includes $46 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 14.7%, and for the last 12 months is 19.6%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.49% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $149,295 which includes -$197 cash and excludes $5,190 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -9.8%, and for the last 12 months is -4.2%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.34% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $101,596 which includes -$506 cash and excludes $2,017 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -33.6%, and for the last 12 months is -27.5%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.16% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $104,455 which includes -$305 cash and excludes $4,498 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -20.3%, and for the last 12 months is -13.3%. Over the same period the benchmark SPY performance was 7.6% and 22.8% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.06% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $108,288 which includes -$570 cash and excludes $4,241 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.