|

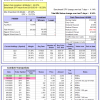

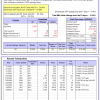

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

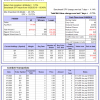

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -4.7%, and for the last 12 months is -0.3%. Over the same period the benchmark E60B40 performance was 3.5% and 9.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.86% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $123,362 which includes -$3,148 cash and excludes $1,528 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -6.5%, and for the last 12 months is -2.0%. Over the same period the benchmark E60B40 performance was 3.5% and 9.9% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.87% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $123,944 which includes -$3,995 cash and excludes $1,661 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -8.3%, and for the last 12 months is -3.7%. Over the same period the benchmark E60B40 performance was 3.5% and 9.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.88% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $124,451 which includes -$4,799 cash and excludes $1,786 spent on fees and slippage. |

|

|

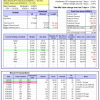

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 317.08% while the benchmark SPY gained 69.88% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 6.08% at a time when SPY gained 4.14%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $104,305 which includes $678 cash and excludes $971 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -21.6%, and for the last 12 months is -14.5%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of Best(SPY-SH) gained 4.36% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $556,009 which includes -$29,265 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -17.4%, and for the last 12 months is -10.2%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.85% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $146,345 which includes -$1,528 cash and excludes $6,455 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -6.2%, and for the last 12 months is 2.0%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of iM-Combo5 gained 5.34% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $144,455 which includes $1,348 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -1.5%, and for the last 12 months is 9.6%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Since inception, on 7/1/2014, the model gained 141.14% while the benchmark SPY gained 82.35% and VDIGX gained 76.13% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.73% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $241,140 which includes $571 cash and excludes $3,580 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -19.1%, and for the last 12 months is -13.4%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 3.53% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $143,734 which includes $3,852 cash and excludes $1,245 spent on fees and slippage. |

|

|

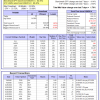

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -12.8%, and for the last 12 months is -3.8%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Since inception, on 6/30/2014, the model gained 104.87% while the benchmark SPY gained 82.35% and the ETF USMV gained 86.42% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.76% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $204,867 which includes $828 cash and excludes $7,041 spent on fees and slippage. |

|

|

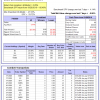

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is -4.3%, and for the last 12 months is -4.2%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Since inception, on 1/3/2013, the model gained 248.39% while the benchmark SPY gained 151.73% and the ETF USMV gained 142.19% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.23% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $348,392 which includes $557 cash and excludes $3,481 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -35.3%, and for the last 12 months is -35.8%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 2.70% at a time when BND gained 0.25%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $137,650 which includes $583 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -6.0%, and for the last 12 months is -4.3%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of iM-Best(Short) gained -3.35% at a time when SPY gained 4.14%. Over the period 1/2/2009 to 7/6/2020 the starting capital of $100,000 would have grown to $75,620 which includes $90,821 cash and excludes $28,078 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 2.3%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.90% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,971 which includes $309 cash and excludes $1,134 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -8.2%, and for the last 12 months is -2.8%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.50% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $119,138 which includes $388 cash and excludes $00 spent on fees and slippage. |

|

|

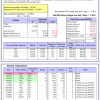

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -22.7%, and for the last 12 months is -17.7%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 2.85% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $118,550 which includes $3,624 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -14.0%, and for the last 12 months is -11.7%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.39% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,552 which includes -$11,738 cash and excludes $3,692 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -34.9%, and for the last 12 months is -42.0%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -0.34% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $121,048 which includes $5,463 cash and excludes $8,803 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 9.9%, and for the last 12 months is 8.7%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.56% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,083 which includes $8,899 cash and excludes $4,898 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -10.3%, and for the last 12 months is -6.9%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.20% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $100,956 which includes $24,321 cash and excludes $1,949 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -35.3%, and for the last 12 months is -35.8%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -1.71% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $101,759 which includes $7,954 cash and excludes $3,972 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -21.7%, and for the last 12 months is -19.0%. Over the same period the benchmark SPY performance was -0.5% and 8.3% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.86% at a time when SPY gained 4.14%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $106,366 which includes $9,337 cash and excludes $3,652 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.