|

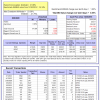

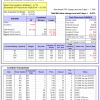

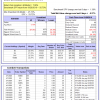

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

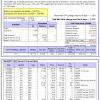

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -6.7%, and for the last 12 months is 1.7%. Over the same period the benchmark E60B40 performance was -0.9% and 9.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.29% at a time when SPY gained 1.02%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $120,826 which includes -$3,464 cash and excludes $1,528 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -8.5%, and for the last 12 months is 0.4%. Over the same period the benchmark E60B40 performance was -0.9% and 9.9% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.29% at a time when SPY gained 1.02%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $121,379 which includes -$4,316 cash and excludes $1,661 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -10.2%, and for the last 12 months is -1.0%. Over the same period the benchmark E60B40 performance was -0.9% and 9.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.29% at a time when SPY gained 1.02%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $121,860 which includes -$5,123 cash and excludes $1,786 spent on fees and slippage. |

|

|

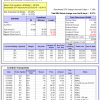

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -26.6%, and for the last 12 months is -15.1%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.47% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $520,315 which includes -$31,787 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -23.8%, and for the last 12 months is -14.8%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.07% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $134,937 which includes $2,800 cash and excludes $6,084 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -16.2%, and for the last 12 months is -3.6%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of iM-Combo5 gained 0.57% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $129,057 which includes $2,259 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -5.2%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Since inception, on 7/1/2014, the model gained 132.02% while the benchmark SPY gained 71.27% and VDIGX gained 69.62% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.03% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $232,020 which includes $380 cash and excludes $3,329 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -22.8%, and for the last 12 months is -15.8%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 3.01% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $137,199 which includes $2,833 cash and excludes $1,245 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -15.5%, and for the last 12 months is -2.6%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Since inception, on 6/30/2014, the model gained 98.53% while the benchmark SPY gained 71.27% and the ETF USMV gained 81.45% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.51% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $198,535 which includes -$104 cash and excludes $6,953 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is -5.1%, and for the last 12 months is 1.3%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Since inception, on 1/3/2013, the model gained 245.76% while the benchmark SPY gained 136.42% and the ETF USMV gained 135.72% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 4.79% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $345,757 which includes -$84 cash and excludes $3,481 spent on fees and slippage. |

|

|

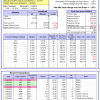

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -33.5%, and for the last 12 months is -27.1%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 2.18% at a time when BND gained 0.47%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $135,092 which includes -$517 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -3.1%, and for the last 12 months is -2.9%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of iM-Best(Short) gained 0.30% at a time when SPY gained 1.38%. Over the period 1/2/2009 to 5/26/2020 the starting capital of $100,000 would have grown to $77,986 which includes $124,240 cash and excludes $27,680 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -7.6%, and for the last 12 months is 3.0%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.52% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $116,205 which includes $174 cash and excludes $1,014 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -12.4%, and for the last 12 months is -3.8%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.54% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $113,668 which includes $1,198 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -25.9%, and for the last 12 months is -16.4%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 3.20% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $113,706 which includes $3,151 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -14.1%, and for the last 12 months is -6.5%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.32% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,286 which includes -$12,029 cash and excludes $3,692 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -35.0%, and for the last 12 months is -37.7%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 0.28% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,846 which includes $5,242 cash and excludes $8,803 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 7.0%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.83% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $139,308 which includes $7,876 cash and excludes $4,898 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -11.5%, and for the last 12 months is -3.4%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.60% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $99,653 which includes $24,029 cash and excludes $1,949 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -33.5%, and for the last 12 months is -27.1%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -0.52% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $104,707 which includes $7,824 cash and excludes $3,972 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -20.6%, and for the last 12 months is -12.3%. Over the same period the benchmark SPY performance was -6.5% and 7.9% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.27% at a time when SPY gained 1.38%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $107,897 which includes $9,171 cash and excludes $3,652 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.