|

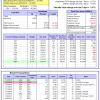

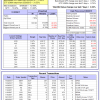

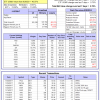

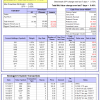

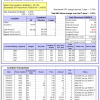

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 18.7%, and for the last 12 months is 19.7%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.74% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $548,500 which includes $7,222 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 22.3%, and for the last 12 months is 24.3%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.24% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $153,638 which includes -$544 cash and excludes $3,437 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 27.0%, and for the last 12 months is 28.2%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of iM-Combo5 gained 1.50% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $125,252 which includes $409 cash and excludes $603 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 13.8%, and for the last 12 months is 16.3%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Since inception, on 7/1/2014, the model gained 65.89% while the benchmark SPY gained 41.96% and VDIGX gained 35.62% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.37% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $165,761 which includes $288 cash and excludes $1,913 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.16% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $221,222 which includes $1,003 cash and excludes $1,818 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 4.3%, and for the last 12 months is 4.0%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.21% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $107,020 which includes -$58 cash and excludes $1,254 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 35.2%, and for the last 12 months is 34.7%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.23% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $143,022 which includes $907 cash and excludes $559 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 7.8%, and for the last 12 months is 6.4%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.27% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $105,893 which includes $684 cash and excludes $881 spent on fees and slippage. | |

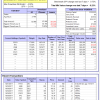

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 19.7%, and for the last 12 months is 21.5%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Since inception, on 6/30/2014, the model gained 67.37% while the benchmark SPY gained 41.96% and the ETF USMV gained 160.23% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.37% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $167,367 which includes $385 cash and excludes $3,686 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 25.4%, and for the last 12 months is 26.5%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Since inception, on 1/5/2015, the model gained 57.77% while the benchmark SPY gained 36.42% and the ETF USMV gained 36.41% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.29% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $157,696 which includes $35 cash and excludes $849 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 15.4%, and for the last 12 months is 18.3%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Since inception, on 3/30/2015, the model gained 32.83% while the benchmark SPY gained 31.55% and the ETF USMV gained 31.55% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.32% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $132,795 which includes $100 cash and excludes $765 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 11.9%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Since inception, on 7/1/2014, the model gained 70.20% while the benchmark SPY gained 41.96% and the ETF USMV gained 160.23% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.84% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $169,944 which includes -$97 cash and excludes $1,179 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 66.91% while the benchmark SPY gained 39.81% and the ETF USMV gained 40.07% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.78% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $166,879 which includes $144 cash and excludes $1,076 spent on fees and slippage. | |

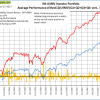

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 36.19% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -6.4%, and for the last 12 months is -5.3%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of iM-Best(Short) gained -1.18% at a time when SPY gained 0.75%. Over the period 1/2/2009 to 11/27/2017 the starting capital of $100,000 would have grown to $90,854 which includes $90,854 cash and excludes $23,210 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 12.3%, and for the last 12 months is 14.2%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.46% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $108,872 which includes $70 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 10.5%, and for the last 12 months is 13.6%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.37% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $109,995 which includes $2,356 cash and excludes $00 spent on fees and slippage. | |

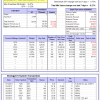

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 14.8%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.27% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $125,423 which includes $1,593 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 20.2%, and for the last 12 months is 21.3%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.74% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,387 which includes $833 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 59.6%, and since inception 59.6%. Over the same period the benchmark SPY performance was 18.1% and 18.1% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 1.35% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $159,640 which includes $587 cash and excludes $578 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 23.1%, and for the last 12 months is 20.5%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.28% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $127,928 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance from inception is 5.1%. The benchmark SPY performance over the same period is 12.4%. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.56% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $105,092 which includes $974 cash and excludes $69 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance from inception is 4.5%. The benchmark SPY performance over the same period is 11.9%. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.49% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $104,400 which includes $1,644 cash and excludes $113 spent on fees and slippage. | |

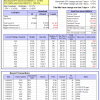

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 38.0%, and for the last 12 months is 42.4%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 1.53% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $155,736 which includes $757 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 18.1%, and for the last 12 months is 19.2%. Over the same period the benchmark SPY performance was 18.1% and 19.8% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.61% at a time when SPY gained 0.75%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $121,417 which includes $1,385 cash and excludes $880 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.