|

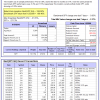

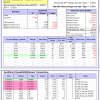

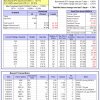

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 0.9%, and for the last 12 months is 9.7%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.37% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $438,922 which includes -$4,971 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is -7.9%, and for the last 12 months is -2.7%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.25% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $121,908 which includes $95 cash and excludes $2,866 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance from inception is -1.4%. The benchmark SPY performance over the same period is 12.9%. Over the previous week the market value of iM-Combo5 gained -0.20% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $98,629 which includes $19,032 cash and excludes $237 spent on fees and slippage. | |

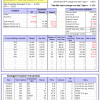

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is -3.9%, and for the last 12 months is -5.6%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 0.00% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $428,133 which includes $191,212 cash and excludes $7,554 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 3.1%, and for the last 12 months is 11.8%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Since inception, on 7/1/2014, the model gained 30.02% while the benchmark SPY gained 14.11% and the ETF VDIGX gained 17.82% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.81% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $130,022 which includes $191 cash and excludes $1,270 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance from inception is -3.4%. The benchmark SPY performance over the same period is 2.4%. Over the previous week the market value of iM-BESTOGA-3 gained -1.29% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $57 which includes $102 cash and excludes Gain to date spent on fees and slippage. | |

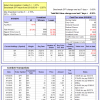

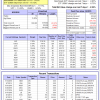

| iM-BESTOGA-3: The model’s out of sample performance YTD is 10.8%, and for the last 12 months is 21.2%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -1.57% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $203,622 which includes $19,002 cash and excludes $767 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance from inception is -1.7%. The benchmark SPY performance over the same period is 2.4%. Over the previous week the market value of iM-BESTOGA-3 gained 0.69% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $98,349 which includes $458 cash and excludes $121 spent on fees and slippage. | |

| iM-Best10(Short Russell3000): The model’s performance YTD is -40.9%, and for the last 12 months is -28.6%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Over the previous week the market value of iM-Best10(Short Russell3000) gained 3.37% at a time when SPY gained -0.85%. Over the period 2/3/2014 to 9/19/2016 the starting capital of $100,000 would have grown to $8,396 which includes $14,314 cash and excludes $1,467 spent on fees and slippage. | |

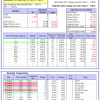

| iM-BestogaX5-System: The model’s out of sample performance from inception is -7.2%. The benchmark SPY performance over the same period is 6.1%. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -1.13% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $92,847 which includes $19,814 cash and excludes $232 spent on fees and slippage. | |

| iM-Best3x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -16.0%, and for the last 12 months is -17.4%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Over the previous week the market value of iM-Best3x4 gained -0.82% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $86,297 which includes $7 cash and excludes $1,591 spent on fees and slippage. | |

| iM-Best2x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -6.5%, and for the last 12 months is -7.1%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Over the previous week the market value of iM-Best2x4 gained -0.42% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $92,392 which includes $1,766 cash and excludes $1,272 spent on fees and slippage. | |

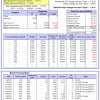

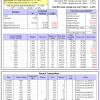

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Since inception, on 7/1/2014, the model gained 39.19% while the benchmark SPY gained 14.11% and the ETF USMV gained 26.45% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.76% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $139,190 which includes -$33 cash and excludes $2,284 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 15.0%, and for the last 12 months is 17.4%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Since inception, on 1/5/2015, the model gained 20.01% while the benchmark SPY gained 9.65% and the ETF USMV gained 16.13% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.26% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $120,010 which includes $217 cash and excludes $493 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 10.8%, and for the last 12 months is 16.3%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Since inception, on 3/31/2015, the model gained 10.24% while the benchmark SPY gained 5.74% and the ETF USMV gained 12.16% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -2.43% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $110,243 which includes $103 cash and excludes $386 spent on fees and slippage. | |

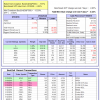

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 21.1%, and for the last 12 months is 23.1%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Since inception, on 7/1/2014, the model gained 42.00% while the benchmark SPY gained 14.11% and the ETF USMV gained 26.45% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -1.89% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $141,999 which includes -$126 cash and excludes $725 spent on fees and slippage. | |

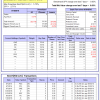

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/30/2014, the model gained 32.80% while the benchmark SPY gained 12.58% and the ETF USMV gained 24.70% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -1.75% at a time when SPY gained -0.85%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $132,795 which includes $102 cash and excludes $535 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 27.98% over SPY. (see iM-USMV Investor Portfolio) | |

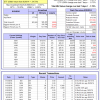

| iM-Best(Short): The model’s out of sample performance YTD is -7.3%, and for the last 12 months is -10.4%. Over the same period the benchmark SPY performance was 6.3% and 11.5% respectively. Over the previous week the market value of iM-Best(Short) gained 4.11% at a time when SPY gained -0.85%. Over the period 1/2/2009 to 9/19/2016 the starting capital of $100,000 would have grown to $97,067 which includes $116,091 cash and excludes $20,239 spent on fees and slippage. |

iM-Best Reports – 9/19/2016

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.