|

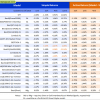

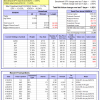

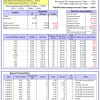

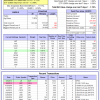

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

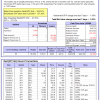

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -2.4%, and for the last 12 months is 20.1%. Over the same period the benchmark SPY performance was 1.5% and -0.6% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.09% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $424,508 which includes $18 cash and excludes $14,506 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is -7.6%, and for the last 12 months is 0.5%. Over the same period the benchmark SPY performance was 1.5% and -0.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.00% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $122,299 which includes -$439 cash and excludes $2,753 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance from inception is -1.5%. The benchmark SPY performance over the same period is 7.8%. Over the previous week the market value of iM-Combo5 gained -0.07% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $98,510 which includes -$48 cash and excludes $172 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 0.8%. Over the same period the benchmark SPY performance was 1.5% and -0.6% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -6.88% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $448,758 which includes $222,441 cash and excludes $6,724 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 11.1%. Over the same period the benchmark SPY performance was 1.5% and -0.6% respectively. Since inception, on 7/1/2014, the model gained 29.37% while the benchmark SPY gained 8.97% and the ETF VDIGX gained 13.62% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.02% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $129,367 which includes $193 cash and excludes $1,080 spent on fees and slippage. | |

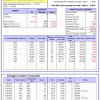

| iM-BESTOGA-3: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 36.7%. Over the same period the benchmark SPY performance was 1.5% and -0.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.61% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $200,840 which includes $17,365 cash and excludes $767 spent on fees and slippage. | |

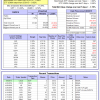

| iM-Best10(Short Russell3000): The model’s performance YTD is -23.4%, and for the last 12 months is 8.2%. Over the same period the benchmark SPY performance was 1.5% and -0.6% respectively. Over the previous week the market value of iM-Best10(Short Russell3000) gained 8.54% at a time when SPY gained -1.00%. Over the period 2/3/2014 to 5/9/2016 the starting capital of $100,000 would have grown to $10,887 which includes $21,300 cash and excludes $1,198 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance from inception is -4.4%. The benchmark SPY performance over the same period is 1.3%. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.44% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $95,638 which includes $20,770 cash and excludes $82 spent on fees and slippage. | |

| iM-Best3x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -12.3%, and since inception -9.9%. Over the same period the benchmark SPY performance was 1.5% and -0.7% respectively. Over the previous week the market value of iM-Best3x4 gained -10.92% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $90,130 which includes $662 cash and excludes $1,160 spent on fees and slippage. | |

| iM-Best2x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -2.1%, and since inception -3.2%. Over the same period the benchmark SPY performance was 1.5% and -0.6% respectively. Over the previous week the market value of iM-Best2x4 gained -5.07% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $96,756 which includes -$416 cash and excludes $839 spent on fees and slippage. | |

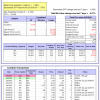

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was 1.5% and -0.6% respectively. Since inception, on 7/1/2014, the model gained 33.91% while the benchmark SPY gained 8.97% and the ETF USMV gained 23.58% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.69% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $133,910 which includes -$192 cash and excludes $1,932 spent on fees and slippage. | |

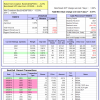

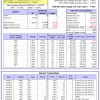

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is -4.0%, and for the last 12 months is -2.5%. Over the same period the benchmark SPY performance was -9.0% and -7.9% respectively. Since inception, on 1/5/2015, the model gained 0.17% while the benchmark SPY gained -6.18% and the ETF USMV gained 1.97% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.18% at a time when SPY gained -4.25%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $100,167 which includes -$69 cash and excludes $371 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is -4.2%, and since inception -4.7%. Over the same period the benchmark SPY performance was -9.0% and -8.4% respectively. Since inception, on 3/31/2015, the model gained -4.68% while the benchmark SPY gained -9.53% and the ETF USMV gained -1.51% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -1.02% at a time when SPY gained -4.25%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $95,321 which includes $43 cash and excludes $211 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is -3.5%, and for the last 12 months is -8.7%. Over the same period the benchmark SPY performance was -9.0% and -7.9% respectively. Since inception, on 7/1/2014, the model gained 13.16% while the benchmark SPY gained -2.37% and the ETF USMV gained 11.04% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.54% at a time when SPY gained -4.25%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $113,158 which includes -$10 cash and excludes $547 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/30/2014, the model gained 8.03% while the benchmark SPY gained -3.68% and the ETF USMV gained 9.51% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.51% at a time when SPY gained -4.25%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $108,029 which includes -$106 cash and excludes $468 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 19.51% over SPY. (see iM-USMV Investor Portfolio) | |

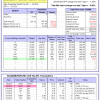

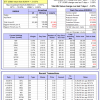

| iM-Best(Short): The model’s out of sample performance YTD is -0.8%, and for the last 12 months is -1.0%. Over the same period the benchmark SPY performance was 1.5% and -0.6% respectively. Over the previous week the market value of iM-Best(Short) gained 0.02% at a time when SPY gained -1.00%. Over the period 1/2/2009 to 5/9/2016 the starting capital of $100,000 would have grown to $103,873 which includes $124,496 cash and excludes $18,937 spent on fees and slippage. |

iM-Best Reports – 5/9/2016

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.