|

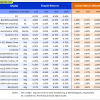

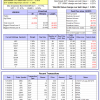

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

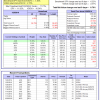

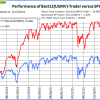

| iM-Best(SPY-SH): The model’s out of sample performance YTD is 8.5%, and for the last 12 months is 31.3%. Over the same period the benchmark SPY performance was -8.0% and -6.6% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.18% at a time when SPY gained 0.18%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $471,707 which includes -$2,391 cash and excludes $14,503 spent on fees and slippage. | |

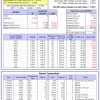

| iM-Combo3: The model’s out of sample performance YTD is -6.7%, and for the last 12 months is 1.4%. Over the same period the benchmark SPY performance was -8.0% and -6.6% respectively. Over the previous week the market value of iM-Combo-3 gained 0.29% at a time when SPY gained -0.22%[/iM]. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $123,507 which includes -$152 cash and excludes $2,336 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is -5.1%, and for the last 12 months is 5.8%. Over the same period the benchmark SPY performance was -8.0% and -6.6% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.45% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $422,457 which includes $6,241 cash and excludes $6,003 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -6.7%, and for the last 12 months is 2.4%. Over the same period the benchmark SPY performance was -8.0% and -6.6% respectively. Since inception, on 7/1/2014, the model gained 17.59% while the benchmark SPY gained -1.20% and the ETF VDIGX gained 2.75% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.79% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $117,585 which includes -$2 cash and excludes $892 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -2.4%, and for the last 12 months is 25.4%. Over the same period the benchmark SPY performance was -8.0% and -6.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.01% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $179,379 which includes $16,053 cash and excludes $767 spent on fees and slippage. | |

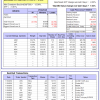

| iM-Best3x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -5.1%, and since inception -2.5%. Over the same period the benchmark SPY performance was -8.0% and -9.9% respectively. Over the previous week the market value of iM-Best3x4 gained 1.93% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $97,488 which includes $889 cash and excludes $817 spent on fees and slippage. | |

| iM-Best2x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -4.5%, and since inception -5.7%. Over the same period the benchmark SPY performance was -8.0% and -9.9% respectively. Over the previous week the market value of iM-Best2x4 gained 1.52% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $94,330 which includes -$929 cash and excludes $573 spent on fees and slippage. | |

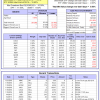

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -6.6%, and for the last 12 months is -3.9%. Over the same period the benchmark SPY performance was -8.0% and -6.6% respectively. Since inception, on 7/1/2014, the model gained 19.08% while the benchmark SPY gained -1.20% and the ETF USMV gained 10.62% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.53% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $119,081 which includes $60 cash and excludes $1,532 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is -5.7%, and for the last 12 months is -5.0%. Over the same period the benchmark SPY performance was -8.0% and -6.6% respectively. Since inception, on 1/5/2015, the model gained -1.67% while the benchmark SPY gained -5.06% and the ETF USMV gained 1.59% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.29% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $98,329 which includes $676 cash and excludes $338 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is -6.2%, and since inception -6.7%. Over the same period the benchmark SPY performance was -8.0% and -7.3% respectively. Since inception, on 3/31/2015, the model gained -6.65% while the benchmark SPY gained -8.45% and the ETF USMV gained -1.88% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.66% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $93,350 which includes $9 cash and excludes $210 spent on fees and slippage. | |

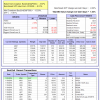

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is -6.4%, and for the last 12 months is -11.9%. Over the same period the benchmark SPY performance was -8.0% and -6.6% respectively. Since inception, on 7/1/2014, the model gained 9.78% while the benchmark SPY gained -1.20% and the ETF USMV gained 10.62% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.56% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $109,777 which includes $95 cash and excludes $530 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/30/2014, the model gained 4.95% while the benchmark SPY gained -2.51% and the ETF USMV gained 9.09% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.74% at a time when SPY gained -0.22%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $104,947 which includes -$304 cash and excludes $452 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 16.40% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 8.6%, and for the last 12 months is 1.9%. Over the same period the benchmark SPY performance was -8.0% and -6.6% respectively. Over the previous week the market value of iM-Best(Short) gained 1.16% at a time when SPY gained -0.22%. Over the period 1/2/2009 to 1/25/2016 the starting capital of $100,000 would have grown to $113,660 which includes $113,660 cash and excludes $17,861 spent on fees and slippage. |

iM-Best Reports – 1/26/2016

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.