|

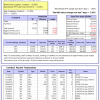

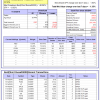

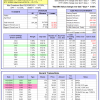

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 5.8%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.65% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $455,192 which includes -$2,720 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is -7.3%, and for the last 12 months is -9.4%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.95% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $122,659 which includes -$1,697 cash and excludes $3,054 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance from inception is -2.6%. The benchmark SPY performance over the same period is 16.4%. Over the previous week the market value of iM-Combo5 gained 1.51% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $97,395 which includes -$1,311 cash and excludes $330 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is -10.0%, and for the last 12 months is -5.2%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -3.05% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $400,813 which includes $191,016 cash and excludes $7,763 spent on fees and slippage. | |

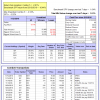

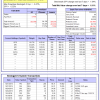

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 11.2%, and for the last 12 months is 10.2%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Since inception, on 7/1/2014, the model gained 40.22% while the benchmark SPY gained 17.71% and the ETF VDIGX gained 16.44% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.43% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $140,223 which includes -$50 cash and excludes $1,435 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance from inception is -5.3%. The benchmark SPY performance over the same period is 5.6%. Over the previous week the market value of iM-BESTOGA-3 gained 0.94% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $43 which includes $105 cash and excludes Gain to date spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 8.0%, and for the last 12 months is 10.0%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 2.47% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $198,423 which includes $20,041 cash and excludes $767 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance from inception is 1.5%. The benchmark SPY performance over the same period is 5.6%. Over the previous week the market value of iM-BESTOGA-3 gained 1.05% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $101,496 which includes $214 cash and excludes $271 spent on fees and slippage. | |

| iM-Best10(Short Russell3000): The model’s performance YTD is -37.8%, and for the last 12 months is -34.6%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Over the previous week the market value of iM-Best10(Short Russell3000) gained -1.35% at a time when SPY gained 1.64%. Over the period 2/3/2014 to 11/21/2016 the starting capital of $100,000 would have grown to $8,831 which includes $13,411 cash and excludes $1,550 spent on fees and slippage. | |

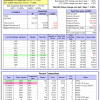

| iM-BestogaX5-System: The model’s out of sample performance from inception is -2.2%. The benchmark SPY performance over the same period is 9.4%. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 1.91% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $97,823 which includes $20,171 cash and excludes $336 spent on fees and slippage. | |

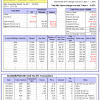

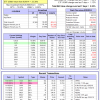

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 7.7%, and for the last 12 months is 7.2%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Since inception, on 7/1/2014, the model gained 37.40% while the benchmark SPY gained 17.71% and the ETF USMV gained 25.11% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.32% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $137,398 which includes $34 cash and excludes $2,587 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 18.1%, and for the last 12 months is 16.6%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Since inception, on 1/5/2015, the model gained 23.16% while the benchmark SPY gained 13.12% and the ETF USMV gained 14.90% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.83% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $123,165 which includes $3 cash and excludes $598 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 11.9%, and for the last 12 months is 12.2%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Since inception, on 3/31/2015, the model gained 11.32% while the benchmark SPY gained 9.08% and the ETF USMV gained 10.97% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.32% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $111,316 which includes $114 cash and excludes $515 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 28.4%, and for the last 12 months is 26.0%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Since inception, on 7/1/2014, the model gained 50.61% while the benchmark SPY gained 17.71% and the ETF USMV gained 25.11% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.65% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $150,608 which includes $137 cash and excludes $839 spent on fees and slippage. | |

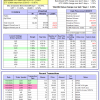

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/30/2014, the model gained 34.71% while the benchmark SPY gained 16.14% and the ETF USMV gained 23.38% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.35% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $134,708 which includes $109 cash and excludes $713 spent on fees and slippage. | |

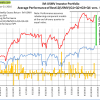

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 29.10% over SPY. (see iM-USMV Investor Portfolio) | |

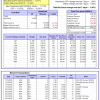

| iM-Best(Short): The model’s out of sample performance YTD is -9.2%, and for the last 12 months is -3.5%. Over the same period the benchmark SPY performance was 9.7% and 7.4% respectively. Over the previous week the market value of iM-Best(Short) gained 1.28% at a time when SPY gained 1.64%. Over the period 1/2/2009 to 11/21/2016 the starting capital of $100,000 would have grown to $95,031 which includes $113,535 cash and excludes $20,729 spent on fees and slippage. |

iM-Best Reports – 11/21/2016

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.