|

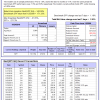

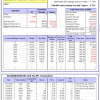

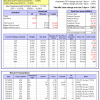

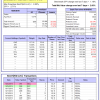

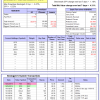

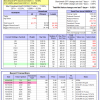

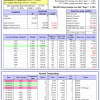

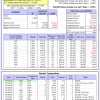

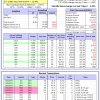

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

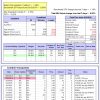

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 4.1%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.20% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $442,000 which includes -$4,971 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is -8.0%, and for the last 12 months is -9.6%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.02% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $121,753 which includes -$144 cash and excludes $2,966 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance from inception is -1.5%. The benchmark SPY performance over the same period is 13.7%. Over the previous week the market value of iM-Combo5 gained 0.05% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $98,538 which includes $18,781 cash and excludes $278 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is -6.2%, and for the last 12 months is -4.4%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.72% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $417,687 which includes $191,243 cash and excludes $7,554 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 3.2%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Since inception, on 7/1/2014, the model gained 28.38% while the benchmark SPY gained 14.90% and the ETF VDIGX gained 14.80% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.65% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $128,375 which includes -$17 cash and excludes $1,331 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance from inception is -3.9%. The benchmark SPY performance over the same period is 3.1%. Over the previous week the market value of iM-BESTOGA-3 gained 0.47% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $43 which includes $103 cash and excludes Gain to date spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 14.6%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.66% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $210,519 which includes $20,041 cash and excludes $767 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance from inception is -1.8%. The benchmark SPY performance over the same period is 3.1%. Over the previous week the market value of iM-BESTOGA-3 gained 2.66% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $98,197 which includes $198 cash and excludes $232 spent on fees and slippage. | |

| iM-Best10(Short Russell3000): The model’s performance YTD is -39.7%, and for the last 12 months is -30.3%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Over the previous week the market value of iM-Best10(Short Russell3000) gained -1.32% at a time when SPY gained 1.18%. Over the period 2/3/2014 to 10/24/2016 the starting capital of $100,000 would have grown to $8,568 which includes $16,912 cash and excludes $1,515 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance from inception is -3.9%. The benchmark SPY performance over the same period is 6.8%. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 4.31% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $96,112 which includes $20,022 cash and excludes $290 spent on fees and slippage. | |

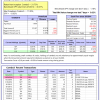

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 5.3%, and for the last 12 months is 6.6%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Since inception, on 7/1/2014, the model gained 34.27% while the benchmark SPY gained 14.90% and the ETF USMV gained 24.80% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.32% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $134,267 which includes -$185 cash and excludes $2,349 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 13.2%, and for the last 12 months is 9.3%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Since inception, on 1/5/2015, the model gained 18.09% while the benchmark SPY gained 10.42% and the ETF USMV gained 14.61% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.18% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $118,092 which includes $92 cash and excludes $541 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 8.0%, and for the last 12 months is 8.3%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Since inception, on 3/31/2015, the model gained 7.39% while the benchmark SPY gained 6.47% and the ETF USMV gained 10.70% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.05% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $107,394 which includes $35 cash and excludes $440 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 22.6%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Since inception, on 7/1/2014, the model gained 43.74% while the benchmark SPY gained 14.90% and the ETF USMV gained 24.80% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.51% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $143,742 which includes $5,122 cash and excludes $764 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/30/2014, the model gained 32.53% while the benchmark SPY gained 13.36% and the ETF USMV gained 23.08% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -0.25% at a time when SPY gained 1.18%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $132,532 which includes $96 cash and excludes $670 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 27.23% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -7.5%, and for the last 12 months is -8.3%. Over the same period the benchmark SPY performance was 7.0% and 5.8% respectively. Over the previous week the market value of iM-Best(Short) gained -0.57% at a time when SPY gained 1.18%. Over the period 1/2/2009 to 10/24/2016 the starting capital of $100,000 would have grown to $96,893 which includes $116,283 cash and excludes $20,524 spent on fees and slippage. |

iM-Best Reports – 10/24/2016

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.