|

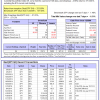

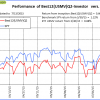

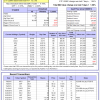

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 126 days, and showing a -2.66% return to 7/13/2015. Over the previous week the market value of Best(SPY-SH) gained -1.51% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $353,694 which includes $19 and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 model currently holds SH, TLT, and XLV, so far held for an average period of 256 days, and showing a 5.39% return to 7/13/2015. Over the previous week the market value of iM-Combo3 gained -0.63% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $121,047 which includes $2,614 and excludes $1,242 spent on fees and slippage. | |

| The iM-Best(Short) model currently holds 2 position(s). Over the previous week the market value of iM-Best(Short) gained -1.12% at a time when SPY gained 1.48%. Over the period 1/2/2009 to 7/13/2015 the starting capital of $100,000 would have grown to $103,824 which includes $145,006 and excludes $19,002 spent on fees and slippage. | |

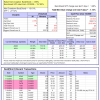

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 2 of them winners, so far held for an average period of 50 days, and showing a -6.99% return to 7/13/2015. Over the previous week the market value of iM-Best10 gained 2.27% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $772,162 which includes $4,792 and excludes $68,583 spent on fees and slippage. | |

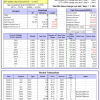

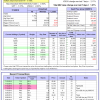

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 8 of them winners, so far held for an average period of 169 days, and showing a 5.34% return to 7/13/2015. Since inception, on 1/5/2015, the model gained 7.89% while the benchmark SPY gained 4.97% and the ETF USMV gained 4.44% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.07% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $107,891 which includes $223 and excludes $154 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 7 of them winners, so far held for an average period of 105 days, and showing a 0.19% return to 7/13/2015. Since inception, on 3/31/2015, the model gained 0.60% while the benchmark SPY gained 1.22% and the ETF USMV gained 0.88% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.04% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $100,599 which includes $836 and excludes $99 spent on fees and slippage. | |

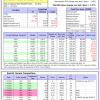

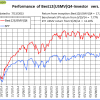

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 115 days, and showing a 7.21% return to 7/13/2015. Since inception, on 7/1/2014, the model gained 25.03% while the benchmark SPY gained 9.23% and the ETF USMV gained 13.73% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.38% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $125,032 which includes $501 and excludes $300 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 246 days, and showing a 17.30% return to 7/13/2015. Since inception, on 9/30/2014, the model gained 17.54% while the benchmark SPY gained 7.77% and the ETF USMV gained 12.16% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.38% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $117,539 which includes -$9 and excludes $151 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 19.22% over SPY. (see iM-USMV Investor Portfolio) | |

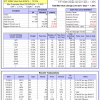

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 11 of them winners, so far held for an average period of 87 days, and showing a 3.37% return to 7/13/2015. Since inception, on 7/1/2014, the model gained 28.60% while the benchmark SPY gained 9.23% and the ETF USMV gained 13.73% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.68% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $128,597 which includes $151 and excludes $1,085 spent on fees and slippage. | |

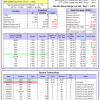

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 8 of them winners, so far held for an average period of 154 days, and showing a 5.75% return to 7/13/2015. Since inception, on 7/1/2014, the model gained 21.84% while the benchmark SPY gained 9.23% and the ETF VDIGX gained 9.18% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.67% at a time when SPY gained 1.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $121,839 which includes -$74 and excludes $450 spent on fees and slippage. |

iM-Best Reports – 7/13/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.