|

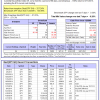

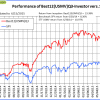

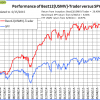

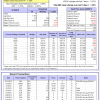

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 98 days, and showing a -1.68% return to 6/15/2015. Over the previous week the market value of Best(SPY-SH) gained -0.28% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $357,242 which includes $19 and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 model currently holds SH, TLT, and XLV, so far held for an average period of 228 days, and showing a 5.84% return to 6/15/2015. Over the previous week the market value of iM-Combo3 gained 0.33% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $121,324 which includes $2,391 and excludes $1,242 spent on fees and slippage. | |

| The iM-Best(Short) model currently holds 2 position(s). Over the previous week the market value of iM-Best(Short) gained -0.02% at a time when SPY gained 0.30%. Over the period 1/2/2009 to 6/15/2015 the starting capital of $100,000 would have grown to $106,763 which includes $149,358 and excludes $18,558 spent on fees and slippage. | |

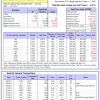

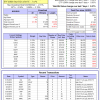

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 3 of them winners, so far held for an average period of 36 days, and showing a -1.29% return to 6/15/2015. Over the previous week the market value of iM-Best10 gained -0.51% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $820,140 which includes $1,306 and excludes $67,824 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 7 of them winners, so far held for an average period of 156 days, and showing a 3.78% return to 6/15/2015. Since inception, on 1/5/2015, the model gained 4.84% while the benchmark SPY gained 4.13% and the ETF USMV gained 1.91% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.28% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $104,844 which includes $810 and excludes $134 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 77 days, and showing a -1.40% return to 6/15/2015. Since inception, on 1/5/2015, the model gained -1.15% while the benchmark SPY gained 0.41% and the ETF USMV gained -1.57% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.57% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $98,851 which includes $670 and excludes $99 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 1 stocks, 1 of them winners, so far held for an average period of 350 days, and showing a 8.26% return to 6/15/2015. Since inception, on 7/1/2014, the model gained 23.38% while the benchmark SPY gained 8.36% and the ETF USMV gained 10.97% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -0.25% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $110,967 which includes -$12,652 and excludes $152 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 218 days, and showing a 16.03% return to 6/15/2015. Since inception, on 9/30/2014, the model gained 16.15% while the benchmark SPY gained 6.91% and the ETF USMV gained 9.44% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -0.18% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $116,153 which includes -$115 and excludes $151 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 18.12% over SPY. (see iM-USMV Investor Portfolio) | |

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 8 of them winners, so far held for an average period of 85 days, and showing a 3.44% return to 6/15/2015. Since inception, on 7/1/2014, the model gained 26.40% while the benchmark SPY gained 8.36% and the ETF USMV gained 10.97% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.08% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $126,400 which includes -$267 and excludes $1,022 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 7 of them winners, so far held for an average period of 210 days, and showing a 7.37% return to 6/15/2015. Since inception, on 7/1/2014, the model gained 16.93% while the benchmark SPY gained 8.36% and the ETF VDIGX gained 7.38% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.35% at a time when SPY gained 0.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $116,932 which includes $48 and excludes $372 spent on fees and slippage. |

iM-Best Reports – 6/15/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.