|

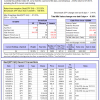

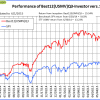

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 84 days, and showing a -2.84% return to 6/1/2015. Over the previous week the market value of Best(SPY-SH) gained -0.38% at a time when SPY gained 0.41% A starting capital of $100,000 at inception on 1/2/2009 would have grown to $353,018 which includes $19 cash and excludes $12,862 spent on fees and slippage. |

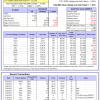

| The iM-Combo3 portfolio currently holds SH, XLV, and TLT so far held for an average period of 214 days, and showing a 6.68% return to 6/1/2015. Over the previous week the market value of iM-Combo3 gained -0.04% at a time when SPY gained 0.41% A starting capital of $100,000 at inception on 2/3/2014 would have grown to $122,106 which includes $3,492 in cash and excludes $1,231 in fees and slippage. | |

| The iM-Best(Short) portfolio currently has no short position. Over the previous week the market value of Best(Short) gained 0.45% at a time when SPY gained 0.41%Over the period 1/2/2009 to 6/1/2015 the starting capital of $100,000 would have grown to $106,876 which is net of $18,424 fees and slippage. | |

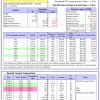

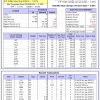

| iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 8 of them winners, so far held for an average period of 29 days, and showing combined 3.14% average return to 6/1/2015. Over the previous week the market value of iM-Best10(S&P 1500) gained 2.44% at a time when SPY gained 0.41%A starting capital of $100,000 at inception of 1/2/2009 would have grown to $843,366 which includes -$1,303 cash and excludes $67,521 spent on fees and slippage. | |

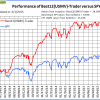

| The iM-Best12(USMV)Q1-Investor currently holds 12 stocks, 8 of them winners, so far held for an average period of 142 days, and showing combined 5.30% average return to 6/1/2015. Since inception, on 1/5/2014, the model gained 6.21% while the benchmark SPY gained 5.36% and the ETF USMV gained 3.99% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.43% at a time when SPY gained 0.41%A starting capital of $100,000 at inception of 1/5/2015 would have grown to $106,209 which includes $658 cash and excludes $134 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor currently holds 12 stocks, 6 of them winners, so far held for an average period of 63 days, and showing combined -0.91% average return to 6/1/2015. Since inception, on 3/30/2015, the model gained -0.68% while the benchmark SPY gained 1.59% and the ETF USMV gained 0.43% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.60% at a time when SPY gained 0.41%A starting capital of $100,000 at inception of 1/5/2015 would have grown to $99,318 which includes $645 cash and excludes $99 spent on fees and slippage. | |

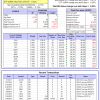

| The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 318 days and showing combined 25.80% average return to 6/1/2015. Since inception, on 6/30/2014, the model gained 25.54% while the benchmark SPY gained 9.63% and the ETF USMV gained 13.23% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained 1.47% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $125,543 which includes $28 cash and $129 for fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 225 days, and showing combined 18.08% average return to 6/1/2015. Since inception, on 9/29/2014, the model gained 17.34% while the benchmark SPY gained 8.17% and the ETF USMV gained 11.67% over the same period. Over the previous week the market value of iM-Best12(USMV)-Q4 gained 0.88% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $117,337 which includes $3 cash and $132 for fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 18.51% over SPY. (see iM-USMV Investor Portfolio) | |

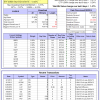

| The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 7 of them winners, so far held for an average period of 100 days, and showing combined 6.64% average return to 6/1/2015. Since inception, on 6/30/2014, the model gained 28.10% while the benchmark SPY gained 9.63% and the ETF USMV gained 13.23% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.03% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $128,097 which includes $335 cash and $1000 for fees and slippage. | |

| The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 196 days, and showing combined 7.15% average return to 6/1/2015. Since inception, on 6/30/2014, the model gained 16.49% while the benchmark SPY gained 9.63% and the VDIGX gained 8.56% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained -0.13% at a time when SPY gained 0.41%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $116,487 which includes -$113 cash and $372 for fees and slippage. |

iM-Best Reports – 6/1/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.