|

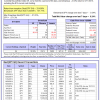

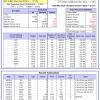

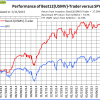

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 63 days, and showing a -2.33% return to 5/11/2015. Over the previous week the market value of Best(SPY-SH) gained 0.24% at a time when SPY gained -0.34% A starting capital of $100,000 at inception on 1/2/2009 would have grown to $354,777 which includes $19 cash and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 portfolio currently holds SH, XLV, and TLT so far held for an average period of 193 days, and showing a 5.81% return to 5/11/2015. Over the previous week the market value of iM-Combo3 gained -0.56% at a time when SPY gained -0.34% A starting capital of $100,000 at inception on 2/3/2014 would have grown to $120,867 which includes $2,078 in cash and excludes $1,221 in fees and slippage. | |

| The iM-Best(Short) portfolio currently has 1 short position. Over the previous week the market value of Best(Short) gained 2.92% at a time when SPY gained -0.34% Over the period 1/2/2009 to 5/11/2015 the starting capital of $100,000 would have grown to $105,863 which is net of $18,094 fees and slippage. | |

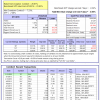

| iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 7 of them winners, so far held for an average period of 53 days, and showing combined -0.61% average return to 5/11/2015. Over the previous week the market value of iM-Best10(S&P 1500) gained -0.08% at a time when SPY gained -0.34% A starting capital of $100,000 at inception of 1/2/2009 would have grown to $844,854 which includes -$564 cash and excludes $65,375 spent on fees and slippage. | |

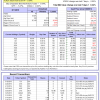

| The iM-Best12(USMV)Q1-Investor currently holds 12 stocks, 9 of them winners, so far held for an average period of 121 days, and showing combined 4.30% average return to 5/11/2015. Since inception, on 1/5/2014, the model gained 5.13% while the benchmark SPY gained 4.88% and the ETF USMV gained 3.54% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.14% at a time when SPY gained -0.34% A starting capital of $100,000 at inception of 1/5/2015 would have grown to $105,126 which includes $574 cash and excludes $134 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor currently holds 12 stocks, 5 of them winners, so far held for an average period of 42 days, and showing combined -0.88% average return to 5/11/2015. Since inception, on 3/30/2015, the model gained -0.70% while the benchmark SPY gained 1.13% and the ETF USMV gained 0.00% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.20% at a time when SPY gained -0.34% A starting capital of $100,000 at inception of 1/5/2015 would have grown to $99,302 which includes $604 cash and excludes $99 spent on fees and slippage. | |

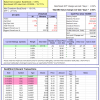

| The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 297 days and showing combined 26.64% average return to 5/11/2015. Since inception, on 6/30/2014, the model gained 26.27% while the benchmark SPY gained 9.13% and the ETF USMV gained 12.74% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained 0.48% at a time when SPY gained -0.34% A starting capital of $100,000 at inception on 6/30/2014 has grown to $126,273, which includes $434 cash and $128 for fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 197 days, and showing combined 18.96% average return to 5/11/2015. Since inception, on 9/29/2014, the model gained 18.16% while the benchmark SPY gained 7.67% and the ETF USMV gained 11.18% over the same period. Over the previous week the market value of iM-Best12(USMV)-Q4 gained 0.61% at a time when SPY gained -0.34% . A starting capital of $100,000 at inception on 9/29/2014 has grown to $118,161 which includes $262 cash and $131 for fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 18.94% over SPY. (see iM-USMV Investor Portfolio) | |

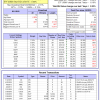

| The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 8 of them winners, so far held for an average period of 99 days, and showing combined 5.70% average return to 5/11/2015. Since inception, on 6/30/2014, the model gained 27.59% while the benchmark SPY gained 9.13% and the ETF USMV gained 12.74% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.47% at a time when SPY gained -0.34% . A starting capital of $100,000 at inception on 6/30/2014 has grown to $127,589 which includes $38 cash and $937 for fees and slippage. | |

| The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 6 of them winners, so far held for an average period of 230 days, and showing combined 6.60% average return to 5/11/2015. Since inception, on 6/30/2014, the model gained 16.11% while the benchmark SPY gained 9.13% and the VDIGX gained 8.94% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained 0.34% at a time when SPY gained -0.34% . A starting capital of $100,000 at inception on 6/30/2014 has grown to $116,110 which includes $514 cash and $328 for fees and slippage. |

iM-Best Reports – 5/11/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.