|

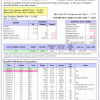

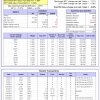

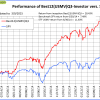

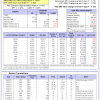

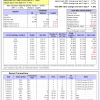

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 0 days, and showing a -0.43% return to 3/9/2015. Over the previous week the market value of Best(SPY-SH) gained -2.63% at a time when SPY gained -1.71% A starting capital of $100,000 at inception on 1/2/2009 would have grown to $361,805 which includes $19 cash and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 149 days, and showing a 10.61% return to 3/9/2015. Over the previous week the market value of iM-Combo3 gained -2.47% at a time when SPY gained -1.71% A starting capital of $100,000 at inception on 2/3/2014 would have grown to $123,751 which includes $1.978 in cash and excludes $1086 in fees and slippage. | |

| The iM-Best(Short) portfolio currently has 2 short positions. Over the previous week the market value of Best(Short) gained 1.13% at a time when SPY gained -1.71% Over the period 1/2/2009 to 3/9/2015 the starting capital of $100,000 would have grown to $106,644 which is net of $17,374 fees and slippage. | |

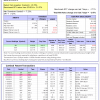

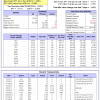

| iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 6 of them winners, so far held for an average period of 32 days, and showing combined 1.54% average return to 3/9/2015. Over the previous week the market value of iM-Best10(S&P 1500) gained -2.59% at a time when SPY gained -1.71% A starting capital of $100,000 at inception of 1/2/2009 would have grown to $836,880 which includes $8 cash and excludes $62,436 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor currently holds 12 stocks, 10 of them winners, so far held for an average period of 58 days, and showing combined 6.17% average return to 3/9/2015. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.80% at a time when SPY gained -1.71% A starting capital of $100,000 at inception of 1/15/2015 would have grown to $106,712 which includes $284 cash and excludes $134 spent on fees and slippage. | |

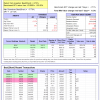

| The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 234 days and showing combined 29.18% average return to 3/9/2015. Since inception, on 6/30/2014, the model gained 28.43% while the benchmark SPY gained 7.49% and the ETF USMV gained 11.63% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained -0.99% at a time when SPY gained -1.71% A starting capital of $100,000 at inception on 6/30/2014 has grown to $128,426, which includes $64 cash and $128 for fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 141 days, and showing combined 18.45% average return to 3/9/2015. Since inception, on 9/29/2014, the model gained 17.41% while the benchmark SPY gained 6.06% and the ETF USMV gained 10.09% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained -1.07% at a time when SPY gained -1.71% A starting capital of $100,000 at inception on 9/29/2014 has grown to $117,407 which includes $7 cash and $131 for fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q3+Q4-Investor resulted in an excess return of 20.1% over SPY. (see iM-USMV Investor Portfolio) | |

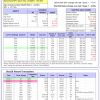

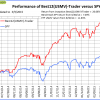

| The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 9 of them winners, so far held for an average period of 107 days, and showing combined 6.21% average return to 3/9/2015. Since inception, on 6/30/2014, the model gained 28.66% while the benchmark SPY gained 7.49% and the ETF USMV gained 11.63% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.12% at a time when SPY gained -1.71% A starting capital of $100,000 at inception on 6/30/2014 has grown to $126,656 which includes $126 cash and $791 for fees and slippage. | |

| The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 188 days, and showing combined 9.10% average return to 3/9/2015. Since inception, on 6/30/2014, the model gained 15.43% while the benchmark SPY gained 7.49% and the VDIGX gained 7.77% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained -1.39% at a time when SPY gained -1.71% A starting capital of $100,000 at inception on 6/30/2014 has grown to $115,427 which includes $327 cash and $302 for fees and slippage. |

iM-Best Reports – 3/9/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.