|

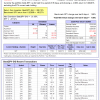

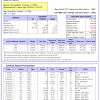

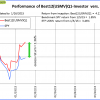

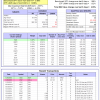

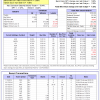

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 35 days, and showing -0.62% return to 1-26-2015. Over the previous week the market value of Best(SPY-SH) gained 1.68% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $360,123 which includes $174 cash and excludes $12,136 spent on fees and slippage. |

|

|

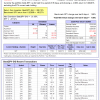

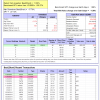

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 133 days, and showing a 9.35% return to 1-26-2015. Over the previous week the market value of iM-Combo3 gained 2.09% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $122,255 which includes $1600 in cash and excludes $1004 in fees and slippage. |

|

|

The iM-Best(Short) portfolio currently has 1 short positions. Over the previous week the market value of Best(Short) gained -1.08% at a time when SPY gained 1.68%. Over the period 1/2/2009 to 1-26-2015 the starting capital of $100,000 would have grown to $111,152% which is net of $16,679 fees and slippage. |

|

|

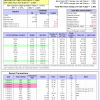

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 4 of them winners, so far held for an average period of 43 days, and showing combined -3.30% average return to 1-26-2015. Over the previous week the market value of iM-Best10(S&P 1500) gained 2.35% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception of 1/2/2009 would have grown to $807,629 which includes $385 cash and excludes $987 spent on fees and slippage. |

|

|

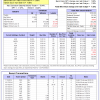

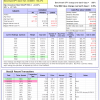

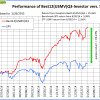

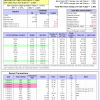

The iM-Best12(USMV)Q1-Investor currently holds 12 stocks, 10 of them winners, so far held for an average period of 21 days, and showing combined 4.23% average return to 1-26-2015. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.97% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception of 1/15/2015 would have grown to $104,209 which includes $503 cash and excludes $99 spent on fees and slippage.. |

|

|

The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 193 days and showing combined 26.34% average return to 1-26-2015. Since inception, on 6/30/2014, the model gained 25.26% while the benchmark SPY gained 5.99% and the ETF USMV gained 12.66% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained 4.65% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $125,257, which includes $40 cash and $114 for fees and slippage. |

|

|

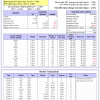

The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 110 days, and showing combined 14.61% average return to 1-26-2015. Since inception, on 9/29/2014, the model gained 13.26% while the benchmark SPY gained 4.58% and the ETF USMV gained 11.10% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 4.00% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $113,261 which includes $30 cash and $100 for fees and slippage. |

,

|

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 8 of them winners, so far held for an average period of 84 days, and showing combined 4.63% average return to 1-26-2015. Since inception, on 6/30/2014, the model gained 24.37% while the benchmark SPY gained 5.99% and the ETF USMV gained 12.66% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.56% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,287 which includes $218 cash and $704 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 178 days, and showing combined 9.09% average return to 1-26-2015. Since inception, on 6/30/2014, the model gained 14.31% while the benchmark SPY gained 5.99% and the VDIGX gained 7.86% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained 1.83% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $114,309 which includes $132 cash and $255 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.