|

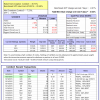

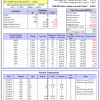

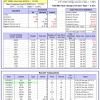

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 21 days, and showing a 2.64% return to 12/21/2015. Over the previous week the market value of Best(SPY-SH) gained -0.05% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $440,282 which includes -$2,391 cash and excludes $14,503 spent on fees and slippage. | |

| The iM-Combo3 model currently holds SH, SSO, and XLB, so far held for an average period of 28 days, and showing a -2.88% return to 12/21/2015. Over the previous week the market value of iM-Combo3 gained -0.64% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $130,726 which includes -$1,996 cash and excludes $2,123 spent on fees and slippage. | |

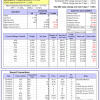

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 9 stocks, 4 of them winners, so far held for an average period of 158 days, and showing a 7.72% return to 12/21/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 2.77% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $448,731 which includes $209,894 cash and excludes $5,620 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 4 of them winners, so far held for an average period of 164 days, and showing a 0.79% return to 12/21/2015. Since inception, on 7/1/2014, the model gained 23.88% while the benchmark SPY gained 6.19% and the ETF VDIGX gained 5.34% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.39% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $123,885 which includes $103 cash and excludes $757 spent on fees and slippage. | |

| The iM-BESTOGA-3 model currently holds 3 stocks, 3 of them winners, so far held for an average period of 494 days, and showing a 37.99% return to 12/21/2015. Over the previous week the market value of iM-BESTOGA-3 gained 0.37% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $181,501 which includes $15,065 cash and excludes $767 spent on fees and slippage. | |

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 8 stocks, 3 of them winners, so far held for an average period of 54 days, and showing a -8.84% return to 12/21/2015. Over the previous week the market value of iM-Best3x4 gained 2.47% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $101,759 which includes -$94 cash and excludes $690 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 6 stocks, 3 of them winners, so far held for an average period of 57 days, and showing a -3.14% return to 12/21/2015. Over the previous week the market value of iM-Best2x4 gained 2.50% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $98,458 which includes $406 cash and excludes $466 spent on fees and slippage. | |

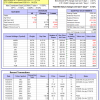

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 5 of them winners, so far held for an average period of 112 days, and showing a -0.56% return to 12/21/2015. Since inception, on 7/1/2014, the model gained 26.24% while the benchmark SPY gained 6.19% and the ETF USMV gained 14.62% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.14% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $126,244 which includes $248 cash and excludes $1,448 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 8 of them winners, so far held for an average period of 261 days, and showing a 0.91% return to 12/21/2015. Since inception, on 1/5/2015, the model gained 3.52% while the benchmark SPY gained 2.05% and the ETF USMV gained 5.26% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.31% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $103,525 which includes $30 cash and excludes $243 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 5 of them winners, so far held for an average period of 205 days, and showing a -9.18% return to 12/21/2015. Since inception, on 3/31/2015, the model gained -1.82% while the benchmark SPY gained -1.60% and the ETF USMV gained 1.67% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.33% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $98,184 which includes $101 cash and excludes $166 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 5 of them winners, so far held for an average period of 113 days, and showing a 0.74% return to 12/21/2015. Since inception, on 7/1/2014, the model gained 16.19% while the benchmark SPY gained 6.19% and the ETF USMV gained 14.62% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -0.39% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $116,190 which includes $356 cash and excludes $493 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 8 of them winners, so far held for an average period of 99 days, and showing a -0.24% return to 12/21/2015. Since inception, on 9/30/2014, the model gained 11.05% while the benchmark SPY gained 4.77% and the ETF USMV gained 13.04% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.32% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $111,050 which includes $8 cash and excludes $373 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 16.03% over SPY. (see iM-USMV Investor Portfolio) | |

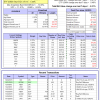

| The iM-Best(Short) model currently holds 2position(s), valued ($42,178). Over the previous week the market value of iM-Best(Short) gained 0.00% at a time when SPY gained -0.01%. Over the period 1/2/2009 to 12/21/2015 the starting capital of $100,000 would have grown to $104,411 which includes $146,588 cash and excludes $21,603 spent on fees and slippage. |

iM-Best Reports – 12/21/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.