|

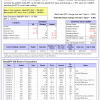

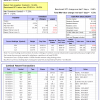

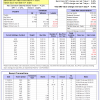

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 14 days, and showing -1.97% return to 1-12-2015. Over the previous week the market value of Best(SPY-SH) gained 0.46% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $355,217 which includes $174 cash and excludes $12,136 spent on fees and slippage. |

|

|

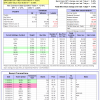

The iM-Combo3 portfolio currently holds SPY, XLV, and TLT so far held for an average period of 130 days, and showing a 8.53% return to 1-12-2015. Over the previous week the market value of iM-Combo3 gained 1.72% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $119,244 which includes -$244 in cash and excludes $943 in fees and slippage. |

|

|

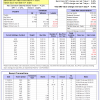

The iM-Best(Short) portfolio currently has 1 short positions. Over the previous week the market value of Best(Short) gained 0.71 at a time when SPY gained 0.46%. Over the period 1/2/2009 to 1-12-2015 the starting capital of $100,000 would have grown to $111,391 which is net of $16,633 fees and slippage. |

|

|

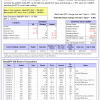

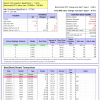

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 2 of them winners, so far held for an average period of 50 days, and showing combined -5.28% average return to 1-12-2015. Over the previous week the market value of iM-Best10(S&P 1500) gained -2.36% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception of 1/2/2009 would have grown to $800,642 which includes $1 cash and excludes $59,545 spent on fees and slippage. |

|

|

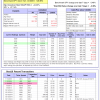

The iM-Best12(USMV)Q1-Investor Currently the portfolio holds 12 stocks, 7 of them winners, so far held for an average period of 7 days and showing combined 0.88% average return to 1-12-2015. Since inception, on 6/30/2014, the model gained 0.87% while the benchmark SPY gained 0.47% and the ETF USMV gained 1.44% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1-Investor gained 0.97% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $100,874 which includes $503 cash and $99 for fees and slippage. |

|

|

The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 196 days and showing combined 20.55% average return to 1-12-2015. Since inception, on 6/30/2014, the model gained 21.11% while the benchmark SPY gained 4.55% and the ETF USMV gained 10.46% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained 0.06% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,114 which includes $277 cash and $100 for fees and slippage. |

|

|

The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 105 days, and showing combined 10.34% average return to 1-12-2015. Since inception, on 9/29/2014, the model gained 10.45% while the benchmark SPY gained 3.16% and the ETF USMV gained 8.93% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained -0.94% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $110,454 which includes $149 cash and $100 for fees and slippage. |

,

|

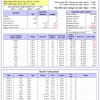

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 8 of them winners, so far held for an average period of 70 days, and showing combined 2.55% average return to 1-12-2015. Since inception, on 6/30/2014, the model gained 21.24% while the benchmark SPY gained 4.55% and the ETF USMV gained 10.46% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.04% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,241 which includes $105 cash and $660 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 164 days, and showing combined 7.15% average return to 1-12-2015. Since inception, on 6/30/2014, the model gained 12.28% while the benchmark SPY gained 4.55% and the VDIGX gained 5.92% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained -0.75% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $112,278 which includes $132 cash and $255 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.