|

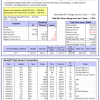

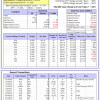

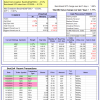

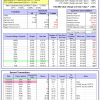

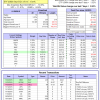

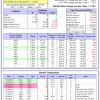

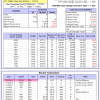

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 91 days, and showing a 10.20% return to 11/23/2015. Over the previous week the market value of Best(SPY-SH) gained 1.68% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $429,557 which includes $127 cash and excludes $13,643 spent on fees and slippage. | |

| The iM-Combo3 model currently holds SPY, SSO, and XLB, so far held for an average period of 33 days, and showing a 3.67% return to 11/23/2015. Over the previous week the market value of iM-Combo3 gained 1.24% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $135,350 which includes $545 cash and excludes $2,000 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 9 stocks, 2 of them winners, so far held for an average period of 130 days, and showing a -1.65% return to 11/23/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -1.40% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $426,243 which includes $189,824 cash and excludes $5,620 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 7 of them winners, so far held for an average period of 144 days, and showing a 3.66% return to 11/23/2015. Since inception, on 7/1/2014, the model gained 26.85% while the benchmark SPY gained 9.43% and the ETF VDIGX gained 11.22% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.36% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $126,848 which includes $157 cash and excludes $730 spent on fees and slippage. | |

| The iM-BESTOGA-3 model currently holds 3 stocks, 3 of them winners, so far held for an average period of 466 days, and showing a 37.80% return to 11/23/2015. Over the previous week the market value of iM-BESTOGA-3 gained 0.28% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $180,957 which includes $14,741 cash and excludes $845 spent on fees and slippage. | |

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 8 stocks, 3 of them winners, so far held for an average period of 54 days, and showing a -7.01% return to 11/23/2015. Over the previous week the market value of iM-Best3x4 gained 2.48% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $99,665 which includes $3,051 cash and excludes $545 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 7 stocks, 2 of them winners, so far held for an average period of 58 days, and showing a -2.48% return to 11/23/2015. Over the previous week the market value of iM-Best2x4 gained 1.77% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $95,468 which includes $797 cash and excludes $380 spent on fees and slippage. | |

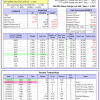

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 8 of them winners, so far held for an average period of 94 days, and showing a 1.18% return to 11/23/2015. Since inception, on 7/1/2014, the model gained 28.55% while the benchmark SPY gained 9.43% and the ETF USMV gained 15.50% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.06% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $128,549 which includes $164 cash and excludes $1,426 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 233 days, and showing a 3.27% return to 11/23/2015. Since inception, on 1/5/2015, the model gained 5.67% while the benchmark SPY gained 5.16% and the ETF USMV gained 6.07% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.93% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $105,668 which includes $46 cash and excludes $243 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 177 days, and showing a -8.07% return to 11/23/2015. Since inception, on 3/31/2015, the model gained -0.68% while the benchmark SPY gained 1.40% and the ETF USMV gained 2.45% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.65% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $99,319 which includes $42 cash and excludes $166 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 7 of them winners, so far held for an average period of 98 days, and showing a 2.12% return to 11/23/2015. Since inception, on 7/1/2014, the model gained 19.67% while the benchmark SPY gained 9.43% and the ETF USMV gained 15.50% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.74% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $119,671 which includes $356 cash and excludes $475 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 8 of them winners, so far held for an average period of 71 days, and showing a 0.93% return to 11/23/2015. Since inception, on 9/30/2014, the model gained 12.17% while the benchmark SPY gained 7.97% and the ETF USMV gained 13.91% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.43% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $112,165 which includes $43 cash and excludes $372 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 15.57% over SPY. (see iM-USMV Investor Portfolio) | |

| The iM-Best(Short) model currently holds 1position(s), valued ($19,622). Over the previous week the market value of iM-Best(Short) gained 0.28% at a time when SPY gained 1.68%. Over the period 1/2/2009 to 11/23/2015 the starting capital of $100,000 would have grown to $98,898 which includes $118,487 cash and excludes $21,334 spent on fees and slippage. |

iM-Best Reports – 11/23/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.