|

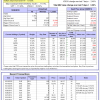

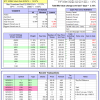

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. |

| The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 63 days, and showing a 9.11% return to 10/26/2015. Over the previous week the market value of Best(SPY-SH) gained 1.78% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $423,379 which includes $64 cash and excludes $13,641 spent on fees and slippage. | |

| The iM-Combo3 model currently holds SH, SPY, and SSO, so far held for an average period of 39 days, and showing a 5.80% return to 10/26/2015. Over the previous week the market value of iM-Combo3 gained 1.30% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $134,492 which includes -$1,658 cash and excludes $1,676 spent on fees and slippage. | |

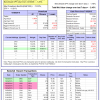

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 9 stocks, 5 of them winners, so far held for an average period of 102 days, and showing a 1.84% return to 10/26/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -3.16% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $434,421 which includes $194,437 cash and excludes $5,620 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 7 of them winners, so far held for an average period of 168 days, and showing a 3.35% return to 10/26/2015. Since inception, on 7/1/2014, the model gained 24.41% while the benchmark SPY gained 8.35% and the ETF VDIGX gained 10.65% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.29% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $124,409 which includes $398 cash and excludes $679 spent on fees and slippage. | |

| The iM-BESTOGA-3 model currently holds 3 stocks, 3 of them winners, so far held for an average period of 438 days, and showing a 39.31% return to 10/26/2015. Over the previous week the market value of iM-BESTOGA-3 gained 1.29% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $182,779 which includes $14,741 cash and excludes $845 spent on fees and slippage. | |

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 7 stocks, 0 of them winners, so far held for an average period of 57 days, and showing a -1.34% return to 10/26/2015. Over the previous week the market value of iM-Best3x4 gained -3.86% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $96,183 which includes $33 cash and excludes $406 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 5 stocks, 0 of them winners, so far held for an average period of 51 days, and showing a -0.86% return to 10/26/2015. Over the previous week the market value of iM-Best2x4 gained -2.45% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $92,106 which includes $135 cash and excludes $258 spent on fees and slippage. | |

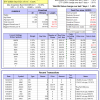

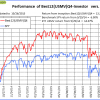

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 5 of them winners, so far held for an average period of 107 days, and showing a -0.66% return to 10/26/2015. Since inception, on 7/1/2014, the model gained 26.35% while the benchmark SPY gained 8.35% and the ETF USMV gained 15.67% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 3.10% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $126,348 which includes $57 cash and excludes $1,344 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 10 of them winners, so far held for an average period of 232 days, and showing a 5.31% return to 10/26/2015. Since inception, on 1/5/2015, the model gained 7.95% while the benchmark SPY gained 4.12% and the ETF USMV gained 6.23% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.48% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $107,949 which includes $130 cash and excludes $227 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 169 days, and showing a -8.78% return to 10/26/2015. Since inception, on 3/31/2015, the model gained -0.62% while the benchmark SPY gained 0.41% and the ETF USMV gained 2.60% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.70% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $99,377 which includes $220 cash and excludes $151 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 1 stocks, 1 of them winners, so far held for an average period of 483 days, and showing a 11.85% return to 10/26/2015. Since inception, on 7/1/2014, the model gained 23.19% while the benchmark SPY gained 8.35% and the ETF USMV gained 15.67% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 2.39% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $115,670 which includes -$7,435 cash and excludes $440 spent on fees and slippage. | |

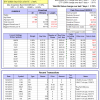

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 8 of them winners, so far held for an average period of 77 days, and showing a 3.65% return to 10/26/2015. Since inception, on 9/30/2014, the model gained 13.50% while the benchmark SPY gained 6.90% and the ETF USMV gained 14.07% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 2.15% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $113,500 which includes $29 cash and excludes $353 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 18.29% over SPY. (see iM-USMV Investor Portfolio) | |

| The iM-Best(Short) model currently holds 1 position(s). Over the previous week the market value of iM-Best(Short) gained 1.05% at a time when SPY gained 1.78%. Over the period 1/2/2009 to 10/26/2015 the starting capital of $100,000 would have grown to $104,595 which includes $125,473 cash and excludes $20,992 spent on fees and slippage. |

iM-Best Reports – 10/27/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.