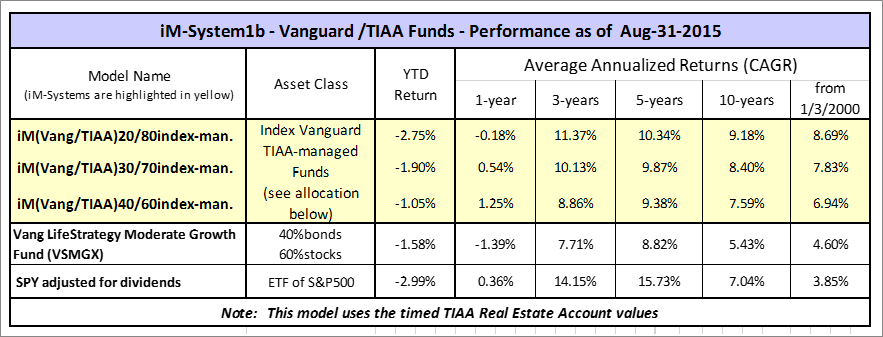

System1b uses Vanguard’s Total Bond Market Index Fund and Total Stock Market Index Fund in combination with TIAA Real Estate-timed (TIAAreal-timed), echoing the broad based Index approach but including TIAAreal-timed to reduce risk. System1b can be directly compared to System1a which does not include TIAAreal-timed. Allocation to TIAAreal-timed remains unchanged during up- and down-market periods.

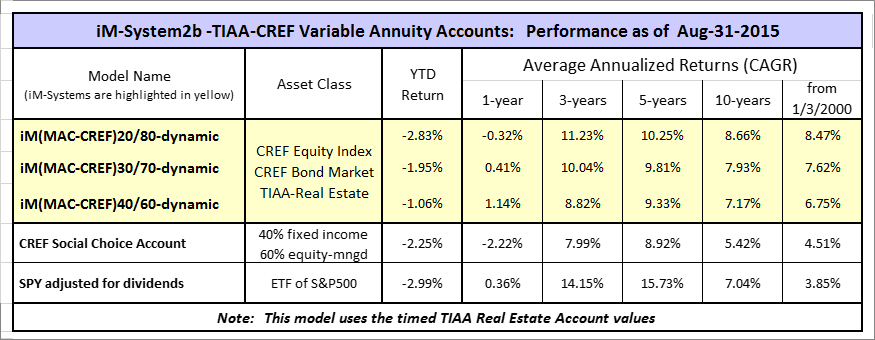

System2b is similar to System1b but uses the CREF Bond Market Account and CREF Equity Index Account instead of the Vanguard Total Bond Market Index Fund and Total Stock Market Index Fund. One can see that System2b has marginally lower returns and higher risk measurements than System1b, which would one lead to conclude that the Vanguard index funds are preferable to the CREF funds. Allocation to TIAAreal-timed remains unchanged during up- and down-market periods.

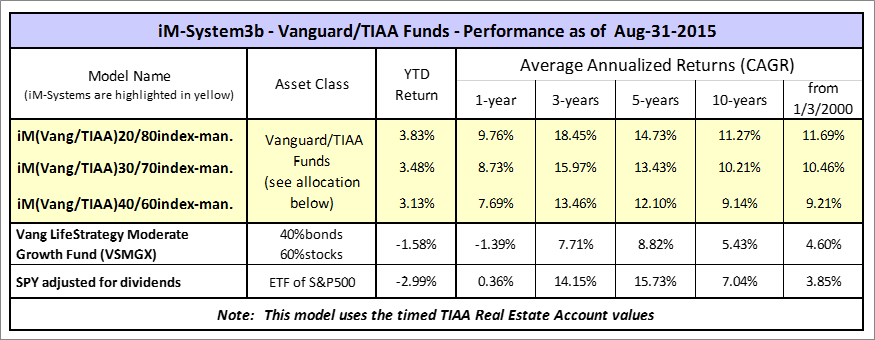

System3b uses the Vanguard Total Bond Market Index Fund and three actively managed Vanguard stock funds in combination with TIAAreal-timed, with allocations optimized to produce high long-term returns and high short returns. This system has a high allocation to the Vanguard Health Care Fund. Allocation to TIAAreal-timed remains unchanged during up- and down-market periods.

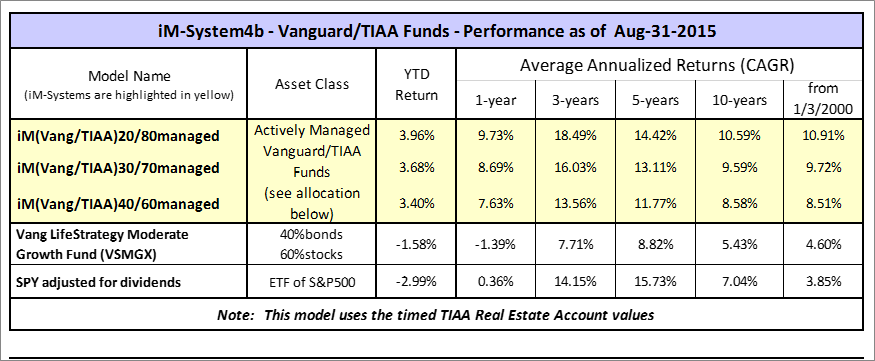

System4b is similar to System3a but uses the Vanguard Short-Term Investment-Grade Fund (VFSTX) instead of the Vanguard Total Bond Market Index Fund. Including the short-term bond fund reduces historic returns, but this system may be more appropriate for periods when rising interest rates are expected.

Leave a Reply

You must be logged in to post a comment.