|

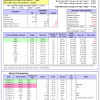

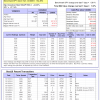

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 7 days, and showing 0.96% return to 12/29/2014. Over the previous week the market value of Best(SPY-SH) gained 0.60% at a time when SPY gained 0.60%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $365,852 which includes $174 cash and excludes $12,136 spent on fees and slippage. |

|

|

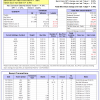

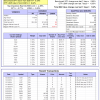

The iM-Combo3 portfolio currently holds SPY, XLV, and TLT so far held for an average period of 116 days, and showing a 7.56% return to 12/29/2014. Over the previous week the market value of iM-Combo3 gained -0.16% at a time when SPY gained 0.60%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $117,688 which includes $563 in cash and excludes $932 in fees and slippage. |

|

|

The iM-Best(Short) portfolio currently has 1 short positions. Over the previous week the market value of Best(Short) gained -0.55% at a time when SPY gained 0.60%. Over the period 1/2/2009 to 12/29/2014 the starting capital of $100,000 would have grown to $109,958 which is net of $16,543 fees and slippage. |

|

|

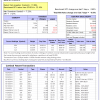

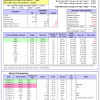

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 7 of them winners, so far held for an average period of 41 days, and showing combined 1.29% average return to 12/29/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained 1.37% at a time when SPY gained 0.60%. A starting capital of $100,000 at inception of 1/2/2009 would have grown to $857,025 which includes $2,852 cash and excludes $59,126 spent on fees and slippage. |

|

|

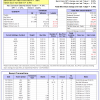

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 182 days and showing combined 23.02% average return to 12/29/2014. Since inception, on 6/30/2014, the model gained 23.50% while the benchmark SPY gained 7.68% and the ETF USMV gained 10.95% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 0.50% at a time when SPY gained 0.60%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $123,497 which includes $185 cash and $100 for fees and slippage. |

|

|

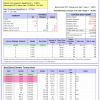

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 91 days, and showing combined 14.04% average return to 12/29/2014. Since inception, on 9/29/2014, the model gained 12.99% while the benchmark SPY gained 5.60% and the ETF USMV gained 9.42% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 1.02% at a time when SPY gained 0.60%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $114,137 which includes $134 cash and $183 for fees and slippage. |

,

|

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 60 days, and showing combined 7.11% average return to 12/29/2014. Since inception, on 6/30/2014, the model gained 24.27% while the benchmark SPY gained 6.07% and the ETF USMV gained 10.95% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.35% at a time when SPY gained 0.60%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $124,701 which includes $46 cash and $618 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 8 of them winners, so far held for an average period of 150 days, and showing combined 11.41% average return to 12/29/2014. Since inception, on 6/30/2014, the model gained 16.62% while the benchmark SPY gained 7.68% and the VDIGX gained 5.79% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained 0.78% at a time when SPY gained 0.60%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $116,624 which includes $16 cash and $255 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.