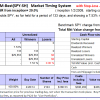

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 133 days, and showing 7.53% return to 9/8/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 133 days, and showing 7.53% return to 9/8/2014

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $426,092 which includes $39 cash and excludes $10,609 spent on fees and slippage.

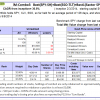

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 126 days, and showing a 10.37% return to 9/8/2014

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 126 days, and showing a 10.37% return to 9/8/2014

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $117,286 which includes $1,355 in cash and excludes $533 in fees and slippage.

The iM-Best(Short) position for Tuesday 9/8/2014: shorts none; covers TSLA. Over the previous week the market value of Best(Short) gained 0.12% at a time when SPY lost 0.01%.

The iM-Best(Short) position for Tuesday 9/8/2014: shorts none; covers TSLA. Over the previous week the market value of Best(Short) gained 0.12% at a time when SPY lost 0.01%.

Over the period 1/2/2009 to 9/12/2014 the starting capital of $100,000 would have grown to $111,237 which is net of $14,371 fees and slippage.

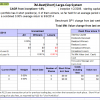

Best10 Portfolio Currently the portfolio holds 10 stocks, 9 of them winners, so far held for an average period of 39 days, and showing combined 5.54% average return to 9/8/2014

Best10 Portfolio Currently the portfolio holds 10 stocks, 9 of them winners, so far held for an average period of 39 days, and showing combined 5.54% average return to 9/8/2014

A starting capital of $100,000 at inception of 1/2/2009 would have grown to $835,420 which includes $18 cash and excludes $54,091 spent on fees and slippage.

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 10 of them winners, and showing combined 8.21% average return to 9/8/2014, while the change in the SPY was 2.49% and iShares MSCI USA Minimum Volatility (USMV) gained only 2.27% over the same period

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 10 of them winners, and showing combined 8.21% average return to 9/8/2014, while the change in the SPY was 2.49% and iShares MSCI USA Minimum Volatility (USMV) gained only 2.27% over the same period

A starting capital of $100,000 at inception on 6/30/2014 has grown to $108,209 which includes $31 cash with fees and slippage accounted for.

Leave a Reply

You must be logged in to post a comment.