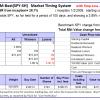

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 105 days, and showing 3.89% return to 8/11/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 105 days, and showing 3.89% return to 8/11/2014

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $411,656 which includes $39 cash and excludes $10,609 spent on fees and slippage.

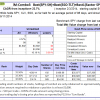

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 98 days, and showing a 4.57% return to 8/11/2014

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 98 days, and showing a 4.57% return to 8/11/2014

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $111,195 which includes $1355 in cash and excludes $533 in fees and slippage.

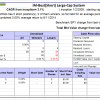

The iM-Best(Short) position for Monday 8/11/2014: none. Over the previous week the market value of Best(Short) gained 0% while SPY lost 0.05%.

The iM-Best(Short) position for Monday 8/11/2014: none. Over the previous week the market value of Best(Short) gained 0% while SPY lost 0.05%.

Over the period 1/2/2009 to 7/21/2014 the starting capital of $100,000 would have grown to $112,368 which is net of $11,900 fees and slippage.

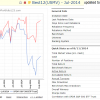

The iM-Best12(USVM)-July-2014 Currently the portfolio holds 12 stocks (6/30/2014), 8 of them winners, and showing combined 1.69% average return to 8/11/2014, while the change in the S&P500 was -0.98%.

The iM-Best12(USVM)-July-2014 Currently the portfolio holds 12 stocks (6/30/2014), 8 of them winners, and showing combined 1.69% average return to 8/11/2014, while the change in the S&P500 was -0.98%.

A starting capital of $100,000 at inception on 6/30/2014 has grown to $101,695 which includes $31.39 cash and excludes fees and slippage

Leave a Reply

You must be logged in to post a comment.