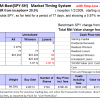

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 77 days, and showing 5.97% return to 7/14/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 77 days, and showing 5.97% return to 7/14/2014

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $417,672 which includes $1,922 cash and excludes $10,605 spent on fees and slippage.

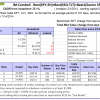

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 107 days, and showing a 10.32% return to 7/14/2014

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 107 days, and showing a 10.32% return to 7/14/2014

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $114,177 which includes $669 in cash and excludes $419 in fees and slippage.

The iM-Best(Short) position for Monday 7/4/2014: SPG only. Over the previous week the market value of Best(Short) lost 0.32% while SPY gained 0.05%.

The iM-Best(Short) position for Monday 7/4/2014: SPG only. Over the previous week the market value of Best(Short) lost 0.32% while SPY gained 0.05%.

Over the period 1/2/2009 to 6/30/2014 the starting capital of $100,000 would have grown to $112,813 which is net of $11,685 fees and slippage.

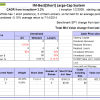

The iM-Best12(USVM)-July-2014 Currently the portfolio holds 12 stocks (6/30/2014), 10 of them winners, and showing combined 1.46% average return to 7/14/2014

The iM-Best12(USVM)-July-2014 Currently the portfolio holds 12 stocks (6/30/2014), 10 of them winners, and showing combined 1.46% average return to 7/14/2014

A starting capital of $100,000 at inception of 6/30/2014 has grown to $101,464 which includes $1.14 cash and excludes fees and slippage

Leave a Reply

You must be logged in to post a comment.