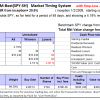

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 49 days, and showing 4.19% return to 6/16/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 49 days, and showing 4.19% return to 6/16/2014

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $410,708 which includes $1,922 cash and excludes $10,605 spent on fees and slippage.

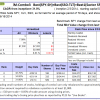

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 79 days, and showing a 7.08% return to 6/16/2014

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 79 days, and showing a 7.08% return to 6/16/2014

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $110,599 which includes $1,706 in cash and excludes $408 in fees and slippage.

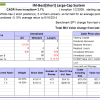

The iM-Best(Short) position for Monday 6/16/2014: CRM and EQIX. Over the previous week the market value of Best(Short) lost 0.04% while SPY gained -0.66%.

The iM-Best(Short) position for Monday 6/16/2014: CRM and EQIX. Over the previous week the market value of Best(Short) lost 0.04% while SPY gained -0.66%.

Over the period 1/2/2009 to 6/16/2014 the starting capital of $100,000 would have grown to $115,691 which is net of $11,328 fees and slippage.

Leave a Reply

You must be logged in to post a comment.