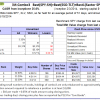

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 21 days, and showing 1.21% return to5/19/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 21 days, and showing 1.21% return to5/19/2014

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $399,031 which includes $1,922 cash and excludes $10,605 spent on fees and slippage.

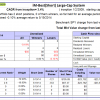

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 51 days, and showing a 3.32% return to 5/19/2014

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 51 days, and showing a 3.32% return to 5/19/2014

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $105,774 which includes $1,706 in cash and excludes $408 in fees and slippage.

The iM-Best(Short) position for Monday of 5/12/2014: TSLA and VTR. Over the previous week the market value of Best(Short) gained 0.05% while SPY lost 0.55%.

The iM-Best(Short) position for Monday of 5/12/2014: TSLA and VTR. Over the previous week the market value of Best(Short) gained 0.05% while SPY lost 0.55%.

Over the period 1/2/2009 to 5/12/2014 the starting capital of $100,000 would have grown to $119,443, which is net of $11,080 fees and slippage.

Leave a Reply

You must be logged in to post a comment.