- If the FED does not change the Federal Funds Rate then the year-on-year inflation rate is set to rise, and we calculate it at 2.5% for December 2016.

- The inflation rate for August was 1.1% and it is predicted to rise to 2.5% by December. Accordingly, prices of Treasury Inflation-Protected Securities (TIPS) should rise as well.

- With inflation rising, and markets uncertain, TIPS should be a reasonably safe investment for some time. Conventional bond funds are expected to perform worse than TIPS funds.

Year-on year inflation of the non-seasonally adjusted CPI is predictable with a high probability for the next few months. Referencing the latest monthly CPI report, and the historic reports, we extract in Table 2 in the Appendix the three main sub-categories of the CPI: (i.) Food, (ii.) Energy, and (iii.) All items less Food and Energy; the relative importance of these are 13.8%, 7.2% and 79%, respectively. We base our prediction on following assumptions:

We note that the food index remained near its value of 12 month ago and we assume this to continue for the next 4 months. The energy index is closely related to the oil price, and assuming the oil price to remain in the band of $40 to $50, the CPI’s energy index is assumed to vary between 186 (April value) and 200 (June Value). The index for “All items less Food and Energy” showed an average month-on-month increase of 0.20% for the last 18 months. If Federal Fund Rates remain unchanged then there is no reason for this trend to be broken. Therefore, with above assumptions we can calculate with high probability the CPI for the coming months

Table 1 lists future CPI based on our calculations for the next six months. We can expect for December an inflation rate of 2.5%, and depending which way the oil price moves a lower 2.3% or an upper 2.7% for that month.

|

Table 1: Future CPI and Y-on-Year Inflation |

|||||

|

CPI |

Y-on-year |

Food |

Energy |

All items less |

|

|

Sep-16 |

241.2 |

1.4% |

247.7 |

193.5 |

248.8 |

|

Oct-16 |

241.7 |

1.6% |

247.7 |

193.5 |

249.3 |

|

Nov-16 |

242.1 |

2.0% |

247.7 |

193.5 |

249.7 |

|

Dec-16 |

242.4 |

2.5% |

247.7 |

193.5 |

250.2 |

|

Jan-17 |

242.8 |

2.5% |

247.7 |

193.5 |

250.7 |

|

Feb-17 |

243.2 |

2.6% |

247.7 |

193.5 |

251.2 |

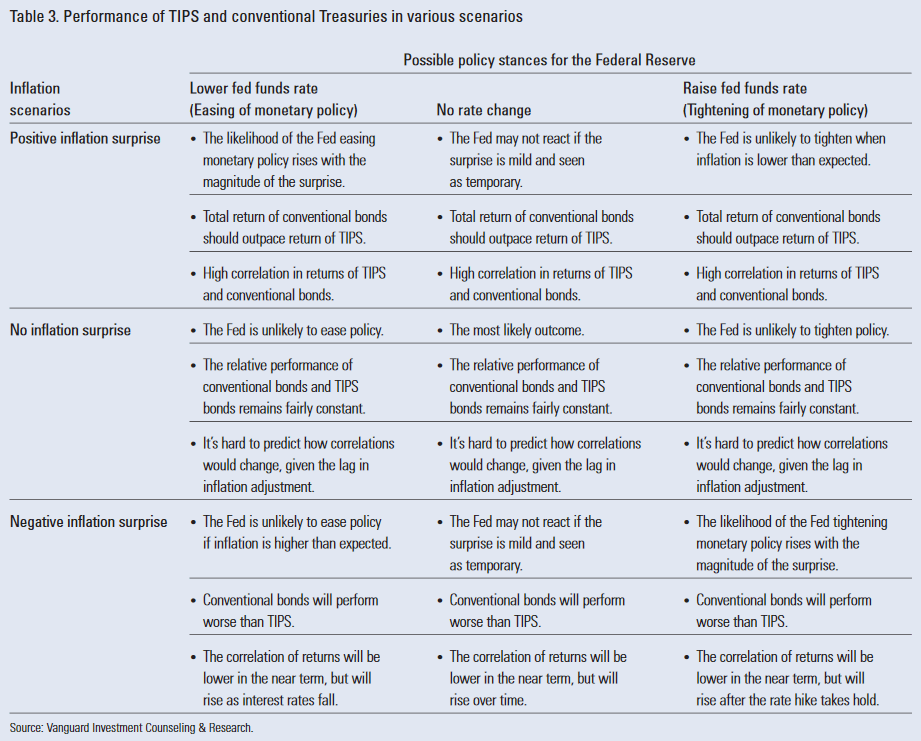

The conservative estimate is that inflation increases from 1.1% to 2.5% over the next few months; this is a Negative Inflation Surprise. In Table 3 in the Appendix, extracted from this Vanguard publication, Vanguard state for a negative inflation surprise, and irrespective of FED action, conventional bond funds will perform worse than TIPS funds like ETFs (SCHP) and (TIP) or mutual fund (VIPSX).

Appendix

How do TIPS react to changes of the inflation rate?

According to TreasuryDirect: “Treasury Inflation-Protected Securities, or TIPS, provide protection against inflation. The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When a TIPS matures, you are paid the adjusted principal or original principal, whichever is greater.

TIPS pay interest twice a year, at a fixed rate. The rate is applied to the adjusted principal; so, like the principal, interest payments rise with inflation and fall with deflation.“

The inflation adjustment is based on a two month-lagged value of the non-seasonally adjusted Consumer Price Index for Urban Consumers (CPI-U). Thus, the August 2016 CPI becomes the TIPS Reference CPI for November 1, 2016.

|

Table 2: CPI and its three main sub-indexes |

|||||

|

CPI |

Y-on-year |

Food |

Energy |

All items less |

|

|

Jan-15 |

233.700 |

246.538 |

192.619 |

239.248 |

|

|

Feb-15 |

234.720 |

246.680 |

196.597 |

240.083 |

|

|

Mar-15 |

236.119 |

246.045 |

204.731 |

241.067 |

|

|

Apr-15 |

236.599 |

246.121 |

203.715 |

241.802 |

|

|

May-15 |

237.805 |

246.187 |

214.330 |

242.119 |

|

|

Jun-15 |

238.638 |

246.680 |

220.861 |

242.354 |

|

|

Jul-15 |

238.654 |

247.003 |

219.852 |

242.436 |

|

|

Aug-15 |

238.316 |

247.671 |

213.248 |

242.651 |

|

|

Sep-15 |

237.945 |

248.632 |

201.641 |

243.359 |

|

|

Oct-15 |

237.838 |

249.052 |

194.500 |

243.985 |

|

|

Nov-15 |

237.336 |

248.306 |

189.267 |

244.075 |

|

|

Dec-15 |

236.525 |

247.903 |

183.378 |

243.779 |

|

|

Jan-16 |

236.916 |

1.38% |

248.631 |

180.171 |

244.528 |

|

Feb-16 |

237.111 |

1.02% |

248.800 |

172.061 |

245.680 |

|

Mar-16 |

238.132 |

0.85% |

247.978 |

179.017 |

246.358 |

|

Apr-16 |

239.261 |

1.13% |

248.413 |

185.652 |

246.992 |

|

May-16 |

240.236 |

1.02% |

247.860 |

192.673 |

247.554 |

|

Jun-16 |

241.038 |

1.01% |

247.482 |

200.035 |

247.821 |

|

Jul-16 |

240.647 |

0.84% |

247.554 |

195.940 |

247.768 |

|

Aug-16 |

240.853 |

1.06% |

247.719 |

193.524 |

248.284 |

From the same Vanguard publication: “A negative inflation surprise means that actual inflation was greater than expected. As a result, the inflation risk premium previously priced into the conventional bond turned out to be insufficient. Negative surprises hurt conventional Treasuries and benefit TIPS, causing TIPS to perform better and reducing correlations of returns for the two types of bonds. Movements in real interest rates may mitigate the change in correlations.”

curious, have you ever considered publishing a signal TIPS vs IEF ?

Tom C