Unemployment

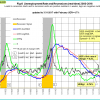

The unemployment rate recession model (article link), has been updated with the February UER of 4.7%. Based on the historic patterns of the unemployment rate indicators prior to recessions one can reasonably conclude that the U.S. economy is not likely to go into recession anytime soon. The growth rate UERg increased to -5.74% (previous at -6.09%) and EMA spread of the UER is -0.14% (previous at -0.15)

The unemployment rate recession model (article link), has been updated with the February UER of 4.7%. Based on the historic patterns of the unemployment rate indicators prior to recessions one can reasonably conclude that the U.S. economy is not likely to go into recession anytime soon. The growth rate UERg increased to -5.74% (previous at -6.09%) and EMA spread of the UER is -0.14% (previous at -0.15)

Here is the link to the full update.

The Dynamic Linearly Detrended Enhanced Aggregate Spread:

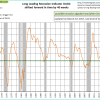

The updated level of this indicator, -42 bps, confirms the January 20, 2017 signal. Based on past history a recession could start at the earliest in Aug-2017, but not later than May-2019. The average lead time to previous recessions provided by DAGS was 15 months which would indicate a recession start for April 2018.

The updated level of this indicator, -42 bps, confirms the January 20, 2017 signal. Based on past history a recession could start at the earliest in Aug-2017, but not later than May-2019. The average lead time to previous recessions provided by DAGS was 15 months which would indicate a recession start for April 2018.

Coppock Indicator for the S&P500

The Coppock indicator for the S&P500 generated a buy signal on May 19, 2016. This model is now in the market. This indicator is described here.

The Coppock indicator for the S&P500 generated a buy signal on May 19, 2016. This model is now in the market. This indicator is described here.

CAPE-Cycle-ID

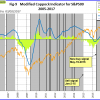

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE. A model using this indicator invests in the market when the Cycle-ID is +2 or 0, and when the Cycle-ID equals -2 the model is in cash. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE. A model using this indicator invests in the market when the Cycle-ID is +2 or 0, and when the Cycle-ID equals -2 the model is in cash. This indicator is described here.

Trade Weighted USD

The rise of the TW$ value seems to be halted for now, the 6 month moving average is increasing.

The rise of the TW$ value seems to be halted for now, the 6 month moving average is increasing.

TIAA Real Estate Account

The 1-year rolling return for the end of last month is 4.92%. A sell signal is not imminent.

The 1-year rolling return for the end of last month is 4.92%. A sell signal is not imminent.

Leave a Reply

You must be logged in to post a comment.