We have revised the iM Gold-Timer and will use this model with additional rules to invest in stocks and bonds when not in gold. The Gold-Stocks-Bonds Model launch is scheduled end January 2017.

The iM Gold-Timer endeavors to signal long-term investment periods for Gold. It uses the SPDR® Gold Shares ETF: GLD. When not invested in GLD the model goes to 100% cash.

The model was backtested on the web-based portfolio simulation platform Portfolio 123 from Jan-2-2000 onward, as this was the first full year when the algorithm had access to all the economic indicators it uses:

- Federal Funds Rate,

- 10-year Treasury Note yield,

- S&P500 Estimated Earnings Yield, and

- Gold Price.

There is also a 11% stop-loss provision in the sell rules.

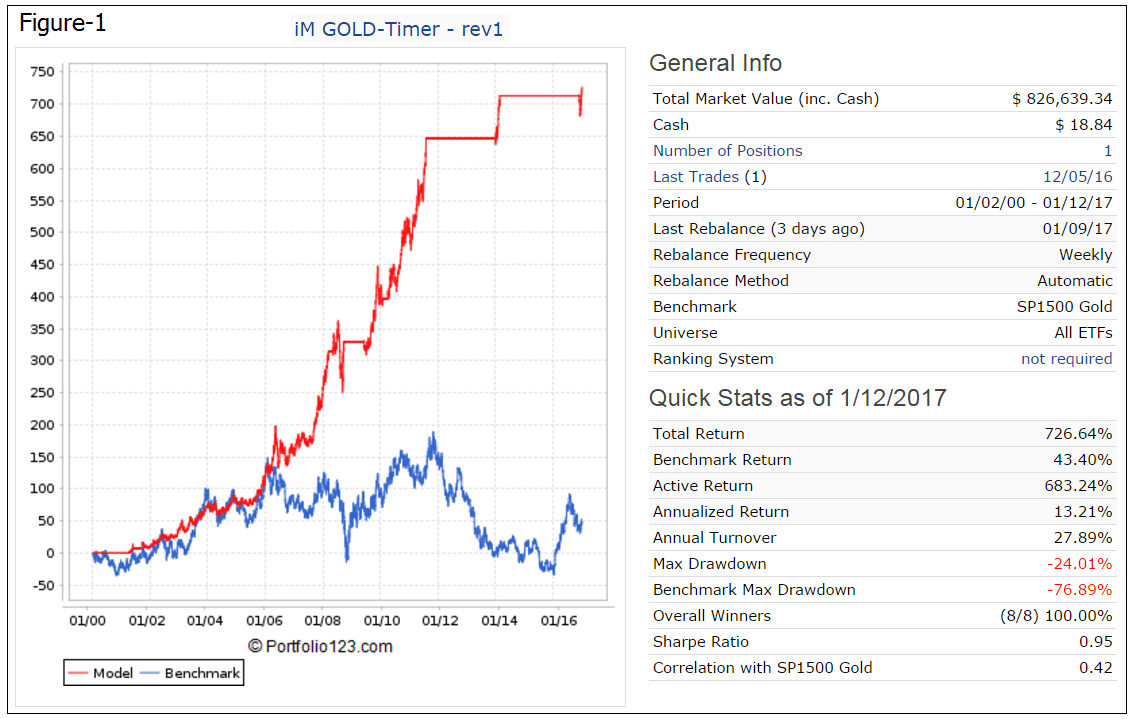

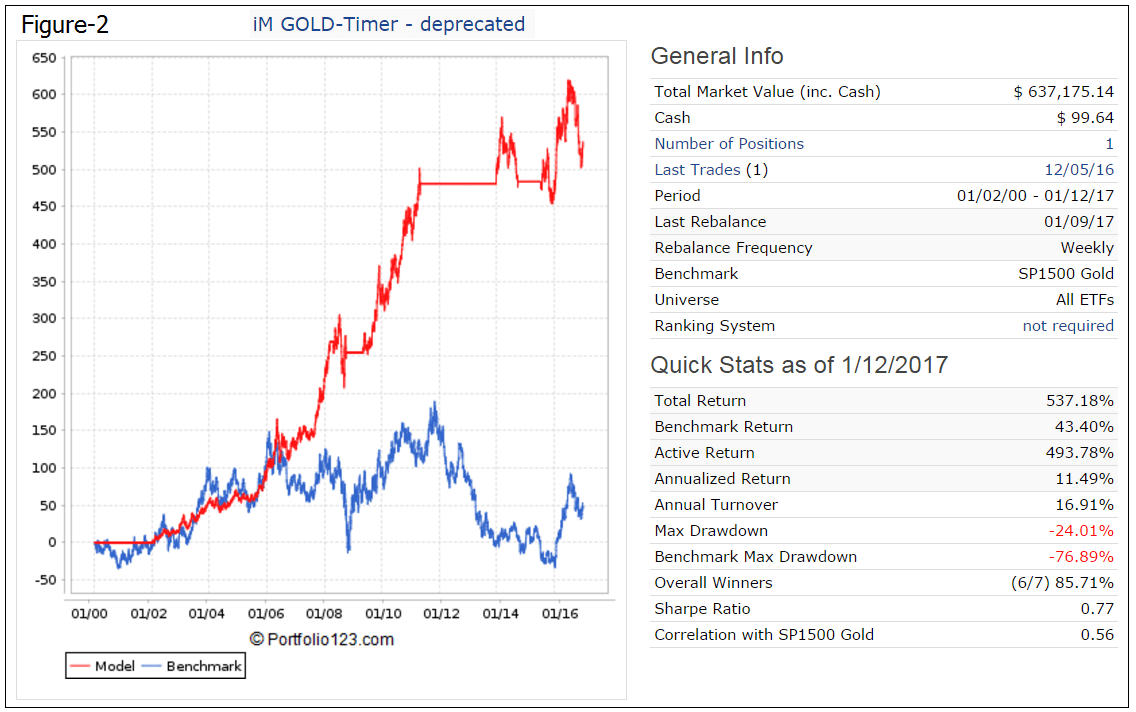

Figure-1 and 2 chart the simulated performance for the revised and deprecated models, respectively.

The timing algorithm is partly based on our research reported in this article: Are Gold Prices Correlated to the Real Federal Funds Rate?

This revised strategy would have produced an average annualized return of about 13.2% from Jan-2000 to Jan-2017, with a maximum drawdown of -24.0%.

The prices for transactions were taken to be “Next Close” after a signal was generated and slippage of 0.1% of the transaction amount was assumed for the simulation. There were only 7 completed trades. The last buy signal was generated on December 5, 2016.

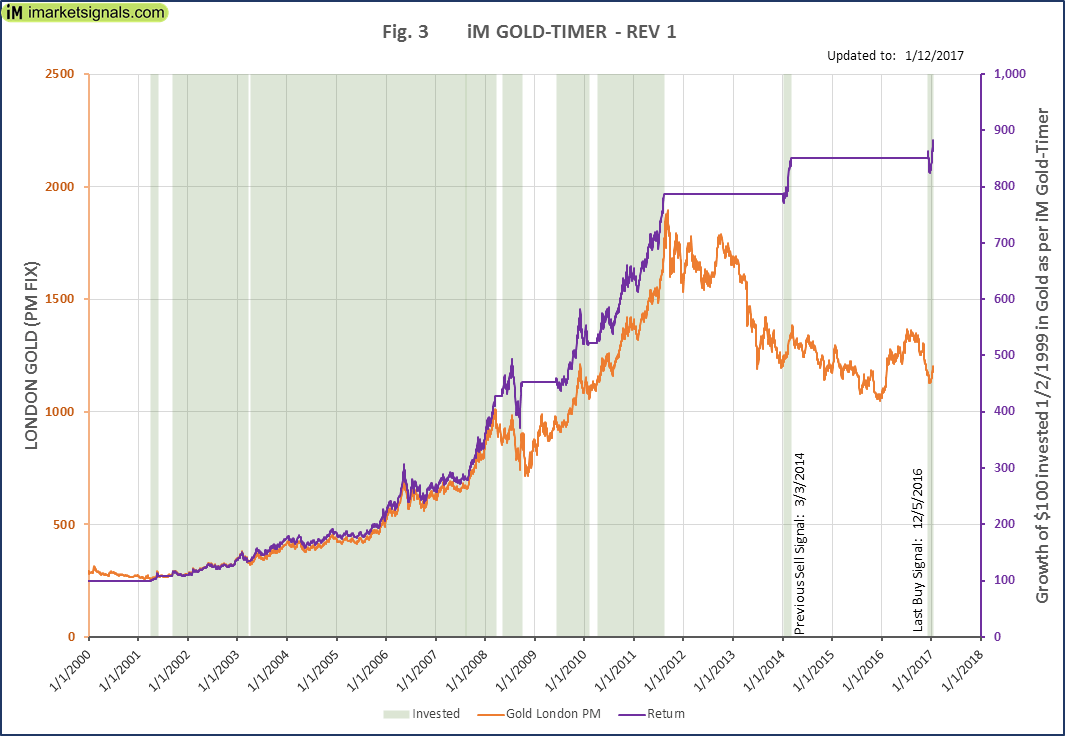

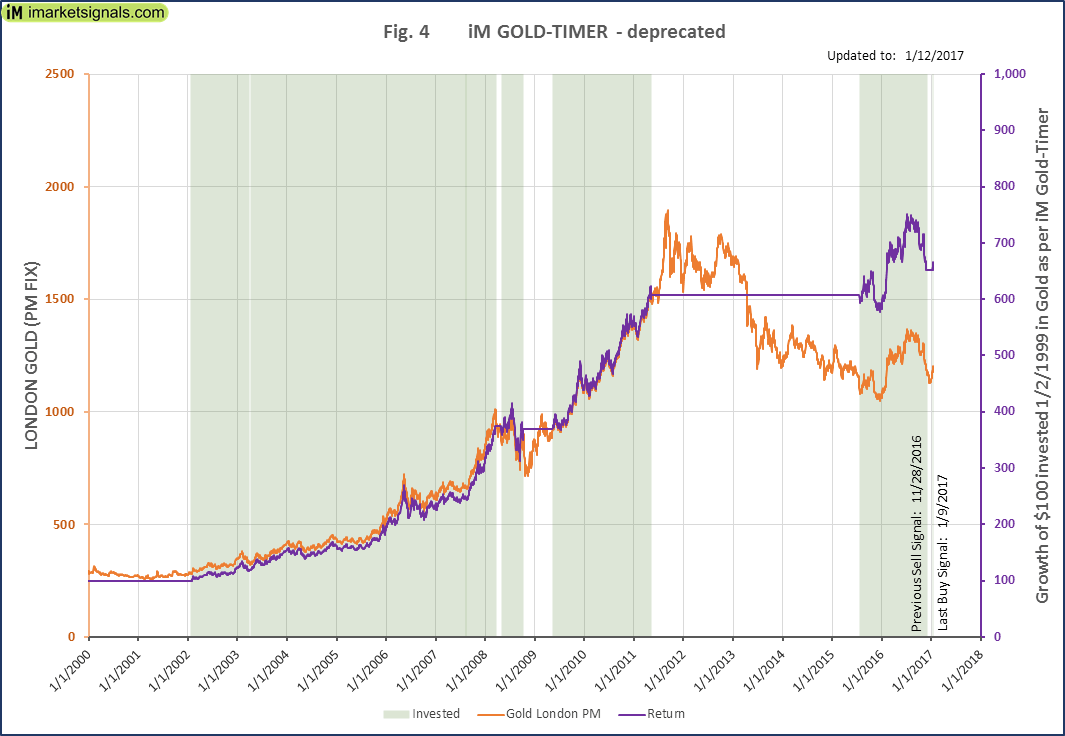

On iMarketSignals (Bronze membership required) we will track this model, but instead of using the ETF GLD as a benchmark, we will track the performance relative the actual gold price (London PM fix), and is updated with the Friday weekly update as a macro signal.

Note: All performance results are hypothetical and the result of backtesting over the period 2000 to 2014. Out-of-sample performance may be different. No claim is made about future performance.

Hi Georg,

Are the signals only provided on Fridays? I keep seeing that the model enters gold on Mondays (on 5/1 most recently), while the weekly update is on fridays.

would just like to know if there is a more real-time way to see the changes.

thanks

We only update on Friday. The signal is provided by our P123 model which is generated on the first trading day of the week.

I am confused. Does the im Gold/Stocks/Bonds timer use this signal? That timer is in bonds, yet the weekly update has this timer in GLD.

Tom C

These are two different models which don’t use the same rules.

The iM GOLD-Timer – rev1 switches between GLD and cash,

whereas the iM-Composite(Gold-Stocks-Bonds) Timer switches between Gold-, Stock-, and Bond ETFs.

The iM GOLD-TIMER Rev-1 sold gold on 12/31/2018 and the model is in cash, while the iM-Composite(Gold-Stocks-Bonds) Timer currently holds XLU and VWOB.

Georg,

Thanks. So you are saying there is a different set of rules that are used for the gold timer that is part of the Composite (Gold-Stocks-Bonds)? I was under the impression that model was merely replacing cash with stocks and bonds based on MC score whenever that timer would have gone to cash.

Thanks,

Tom C

I am looking at this from the Composite (Gold-Stocks-Bonds) description:

* The iM-Gold Timer and the iM-Composite Market Timer are used in combination to signal periodic investments in gold, stocks and bonds.

* From Jan-2000 to Jan-2017 the Gold Timer signaled eight gold investment periods totaling only 9.3 years, while for the remaining periods totaling 7.7 years the model would have been in cash.

* During the “cash periods” the Composite Market Timer provides the signals when to invest in stock and/or bond ETFs. Bond ETFs include the ETF (XLU) are also selected according to the prevailing Market Climate Score (MC-Score) and a ranking system.

So I guess, my question is: what is the im-Gold-timer discussed here, if it is not the same as the other one?

Thanks,

Tom C

Any clue to what I’m missing would be greatly appreciated.

Tom C

The buy and sell rules for Gold are the same for both models.

However if the buy rules for Gold are not true then iM-Composite(Gold-Stocks-Bonds)Timer goes to stock or bond ETFs.

It sells those ETFs when the buy rules for Gold are true, or according to the Composite Market Timer’s rules. Therefore the periods when the iM-Composite(Gold-Stocks-Bonds)Timer holds stock or bond ETFs do not coincide with the periods when the iM GOLD-Timer is in Cash, nor will the gold holding periods be necessarily the same.

Curious, would there be a small boost in performance by using TIP instead of cash?

Tom C

Can you provide a list of trades for this model? I didn’t see them on here. Thanks.

Tom C

could you backtest this strategy using the GDX etf (c. 2006) please? And ty so much in advance.