The model is revised by the iM Gold-Time -Rev 1

The iM Gold-Timer timer endeavors to signal long-term investment periods for Gold. It uses the SPDR® Gold Shares ETF: GLD. When not invested in GLD the model goes to 100% cash.

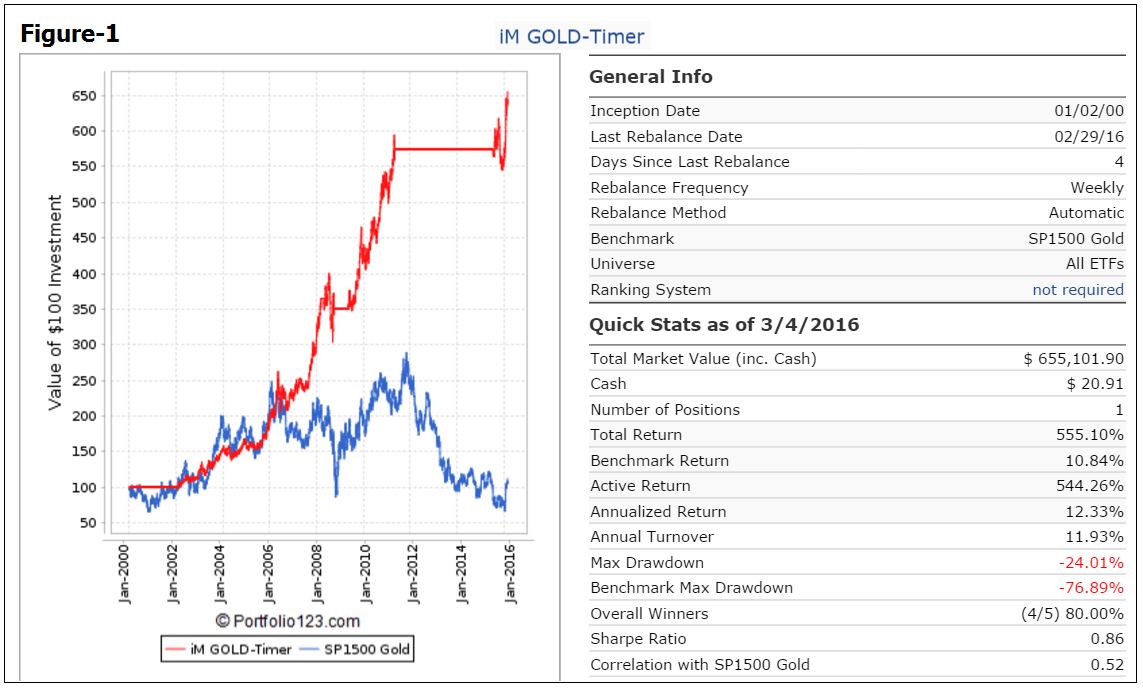

The model was backtested on the web-based portfolio simulation platform Portfolio 123 from Jan-2-2000 onward, as this was the first full year when the algorithm had access to all the economic indicators it uses:

- Federal Funds Rate,

- 10-year Treasury Note yield,

- S&P500 Estimated Earnings Yield, and

- Consumer Price Index.

There is also a 13% stop-loss provision in the sell rules. Figure 1 charts the simulated performance of this model.

The timing algorithm is partly based on our research reported in this article: Are Gold Prices Correlated to the Real Federal Funds Rate?

This strategy would have produced an average annualized return of about 12.3% from Jan-2000 to beginning of Mar-2016, with a maximum drawdown of -24.0%.

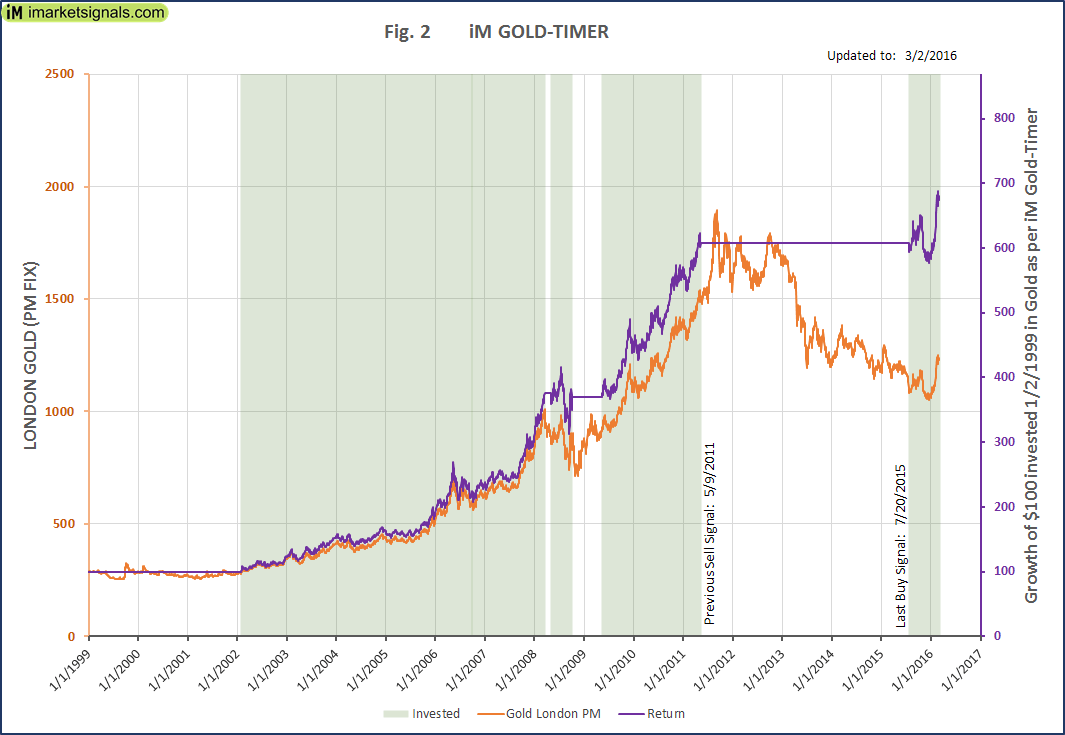

The prices for transactions were taken to be “Next Close” after a signal was generated and slippage of 0.1% of the transaction amount was assumed for the simulation. There were only 4 completed trades. The last buy signal was generated on Jul-20-2015, and GLD has gained 14.1% since then to Mar-3-2016.

On iMarketSignals (Bronze membership required) we will track this model, but instead of using the ETF GLD, we will track the performance relative the actual gold price (London PM fix), and is updated with the Friday weekly update as a macro signal.

Note: All performance results are hypothetical and the result of backtesting over the period 2000 to 2014. Out-of-sample performance may be different. No claim is made about future performance.

Can you run the model with GDX Gold Miners in place of GLD? How does that affect:

Return

Max DD

1 Yr Rolling Return

What happens to performance when you short gold instead of going to cash, using DGZ for example?

Return

Max DD

1 Yr Rolling Return

Georg,

I would like to see the results of this model when combined in a book with combo 5, 6 or 7. Can you do this? Have you thought about allowing subscribers to mix and match the various proprietary models you offer into our own books? I know we can do some of that on P123, but not all your models are available on that sight. I would gladly pay extra for that ability. Just a thought:).

Thanks,

Jon

Anton,

Can you please provide the exact dates of each entry and exit over the time frame of this study?

Thank you,

Paul

Hello George,

How does this model differ from Coppock model, and are there any other sell rules besides 13% stop-loss? Also, is there a 52 week or 43% gain limit as with the Coppock model?

Thanks

John