- iM-Vanguard Systems use a combination of Vanguard bond- and stock-funds, and switch assets according to stock-market climate.

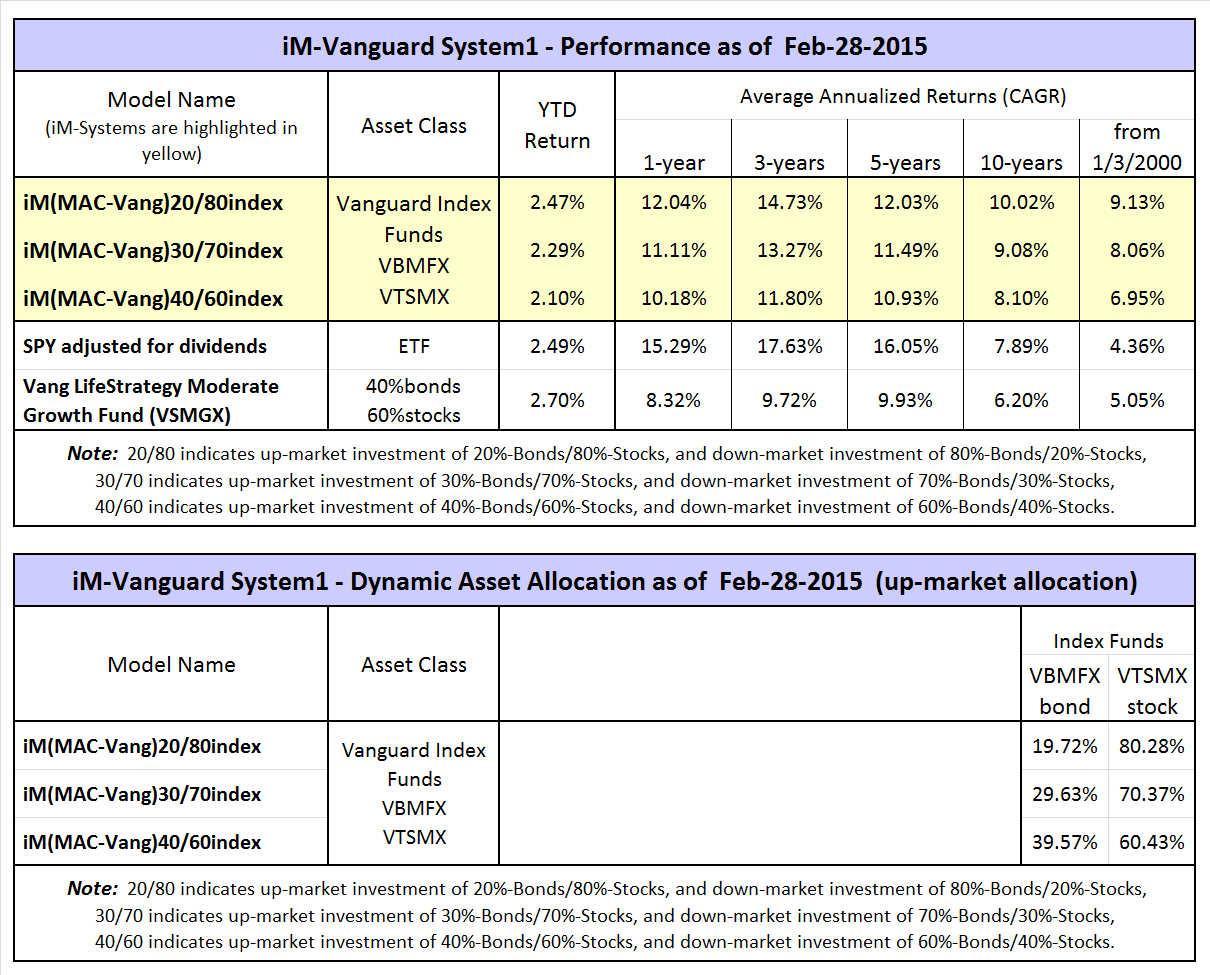

- Backtests show that models using index funds produce better returns when a dynamic asset allocation strategy is employed (System1) than buy-and-hold.

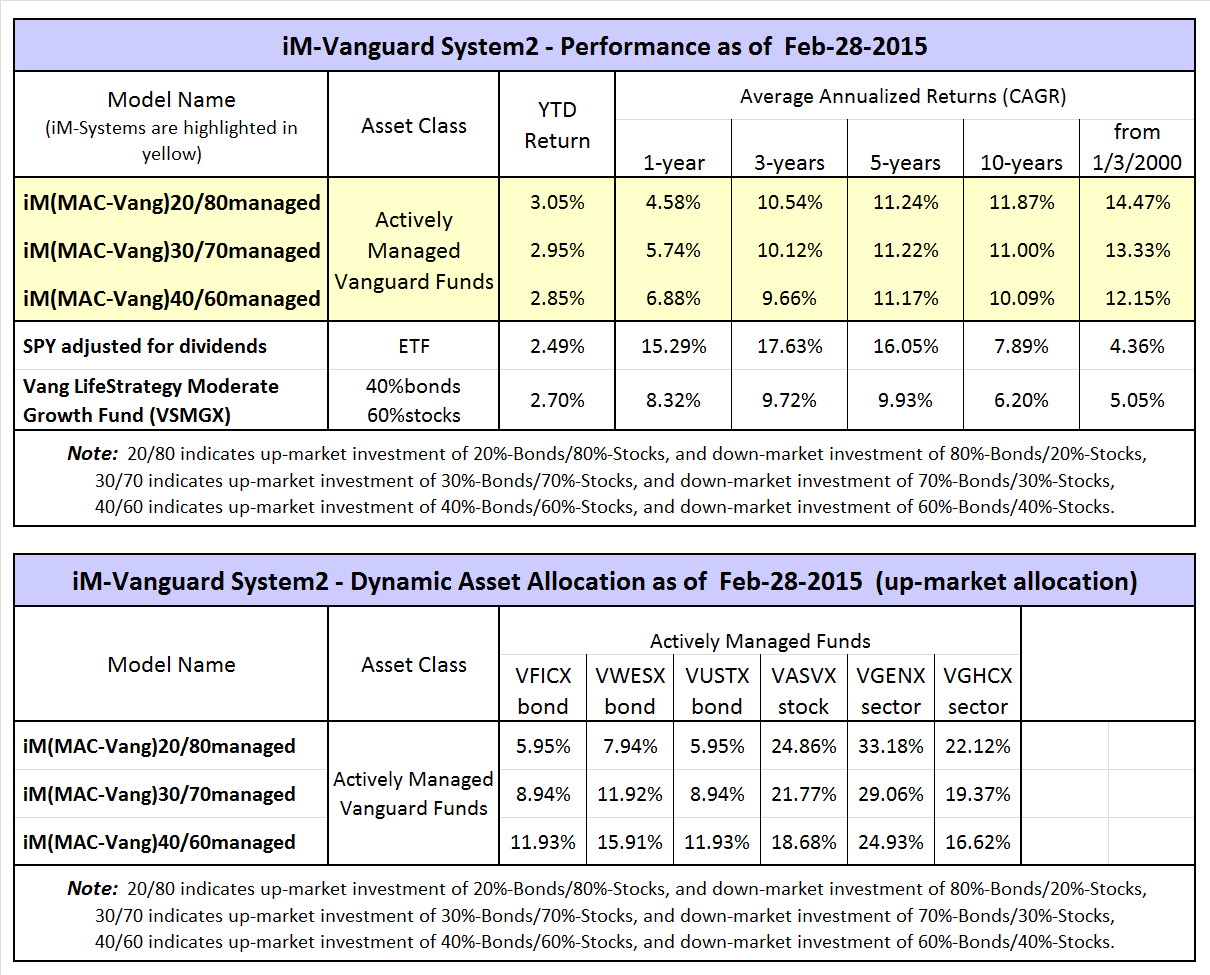

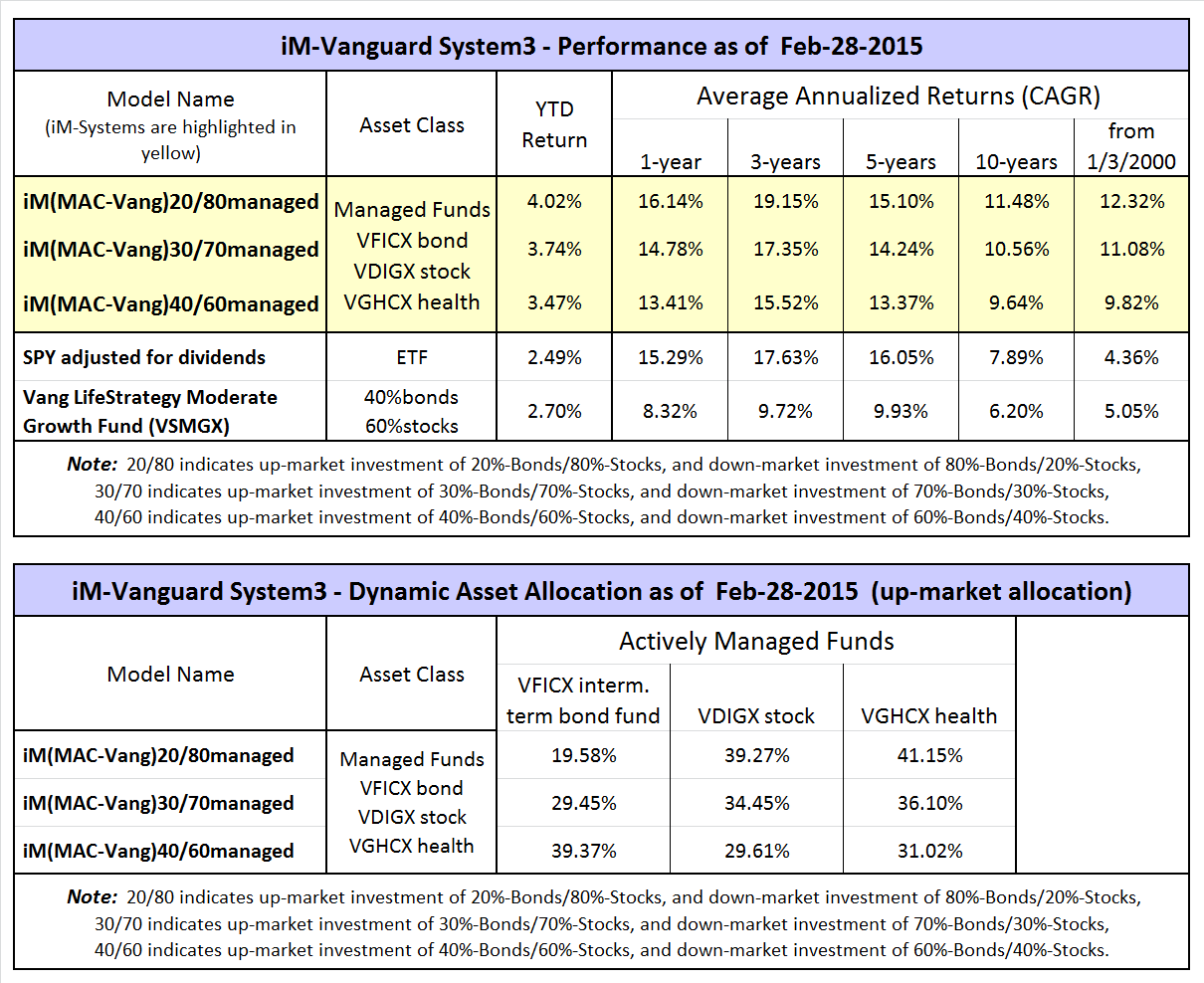

- Higher returns can be obtained from actively managed Vanguard funds with dynamic asset allocation (System2 and System3). System3 uses only two stock funds and one intermediate-term bond fund.

Stock-market timing model

The dynamic asset allocation strategy requires that during up-market periods more money is allocated to stock funds than bond funds, and during down-market periods more money is allocated to bond funds than stock funds.

The up- and down-market periods come from our MAC-US (backtested over 65 years). From 2000 to 2014 the MAC-US signaled only 5 down-market periods and 6 up-market periods, including the current up-market period.

System1 Funds

- Total Bond Market Index Fund (VBMFX) – Vang. Risk Potential 2

- Total Stock Market Index Fund (VTSMX) – Vang. Risk Potential 4

System2 Funds

- Intermediate-Term Investment-Grade Fund (VFICX) – Vang. Risk Potential 2

- Long-Term Invest-Grade Fund (VWESX) – Vang. Risk Potential 3

- Long-Term Treasury Fund (VUSTX) – Vang. Risk Potential 3

- Selected Value Fund (VASVX) – Vang. Risk Potential 5

- Energy Fund (VGENX) – Vang. Risk Potential 5

- Health Care Fund (VGHCX) – Vang. Risk Potential 5

System3 Funds

- Intermediate-Term Investment-Grade Fund (VFICX) – Vang. Risk Potential 2

- Dividend Growth Fund (VDIGX) – Vang. Risk Potential 4

- Health Care Fund (VGHCX) – Vang. Risk Potential 5

Risk

The Vanguard Risk Potential should provide a measure of risk for each fund. It would appear from this that:

- System1 has the lowest risk potential,

- System3 has slightly more risk potential than System1,

- System2 has the highest risk potential.

Performance

Performance for the iM-Vanguard Systems from Jan-2000 to end of Feb-2015 is shown in the tables below for various bond/stock allocations.

Only System3 20/80 out-performed SPY over the lat 3 years, with System2 showing the worst performance. Over a period of 10 years and longer System2 would have had the best performance.

Conclusion

Investors in Vanguard funds can achieve good returns with less risk by following a simple market timing strategy to decide on the asset allocation for their investment. A dynamic asset allocation strategy dependent on stock-market climate is the key to better returns.

Following the iM-Vanguard Systems with dynamic asset allocation

Monthly updates of asset allocation and performance for all Vanguard Systems are posted on our website.

Can I apply this system for ETFs (e.g. VTV, VDE, VHT) instead of the Vanguard mutual funds? If not what you can use ETFs?

I think many subscribers would be interested to use Vanguard ETFs

Yes, one can use representative ETFs instead of mutual funds. Reason we used mutual funds is that there is historic data available for a longer period for them than for corresponding ETFs.