The iM-USMV Investor Portfolio consists of the four quarterly displaced Best12(USMV)-Investor models at iMarketSignals. The purpose of the combination model is to check whether our hypothesis – ranking the holdings of USMV, the iShares MSCI USA Minimum Volatility ETF, and selecting a portfolio of the 12 top ranked stocks, provides higher returns for the portfolio than for the underlying ETF – is supported by the actual performances of the model over longer period of time.

This portfolio combines the four Best12(USMV)-Investor models:

- Best12(USMV)Q1-Investor (started January 2015)

- Best12(USMV)Q2-Investor (will start April 2015)

- Best12(USMV)Q3-Investor (started July 2014)

- Best12(USMV)Q4-Investor (started October 2014)

where Q1, Q2, Q3, and Q4 are abbreviations for quarter 1, quarter 2, quarter 3, and quarter 4 of the calendar year, respectively.

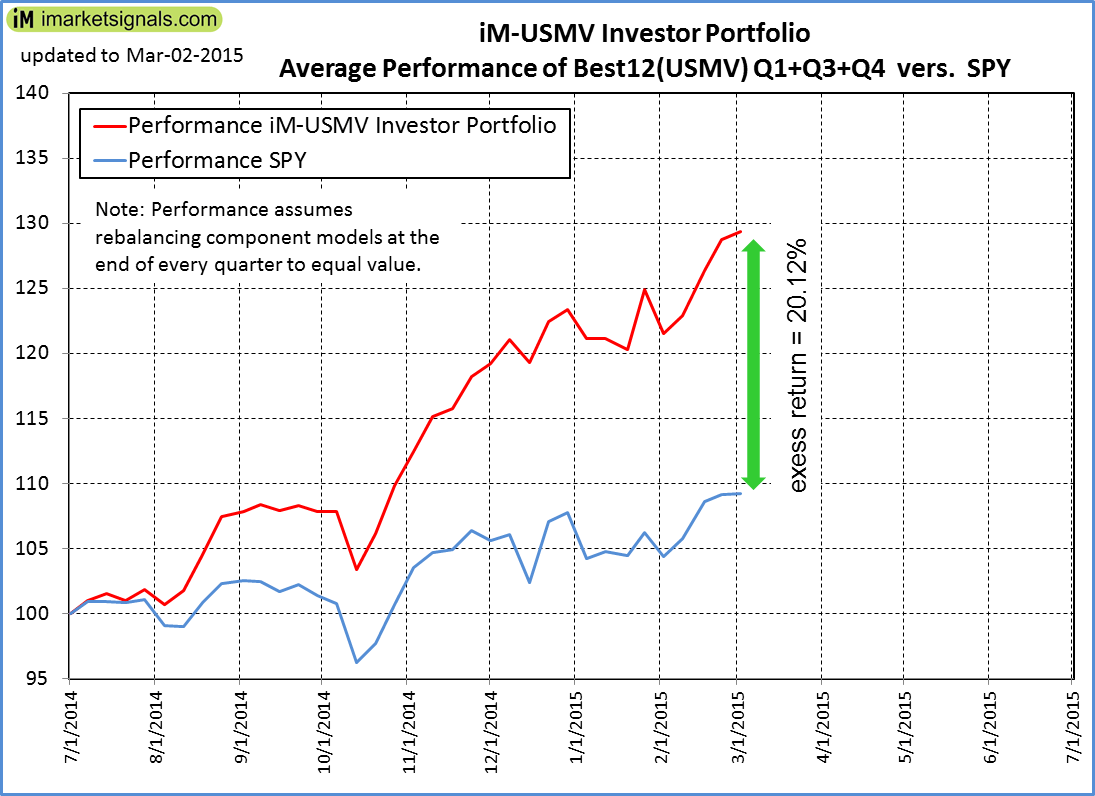

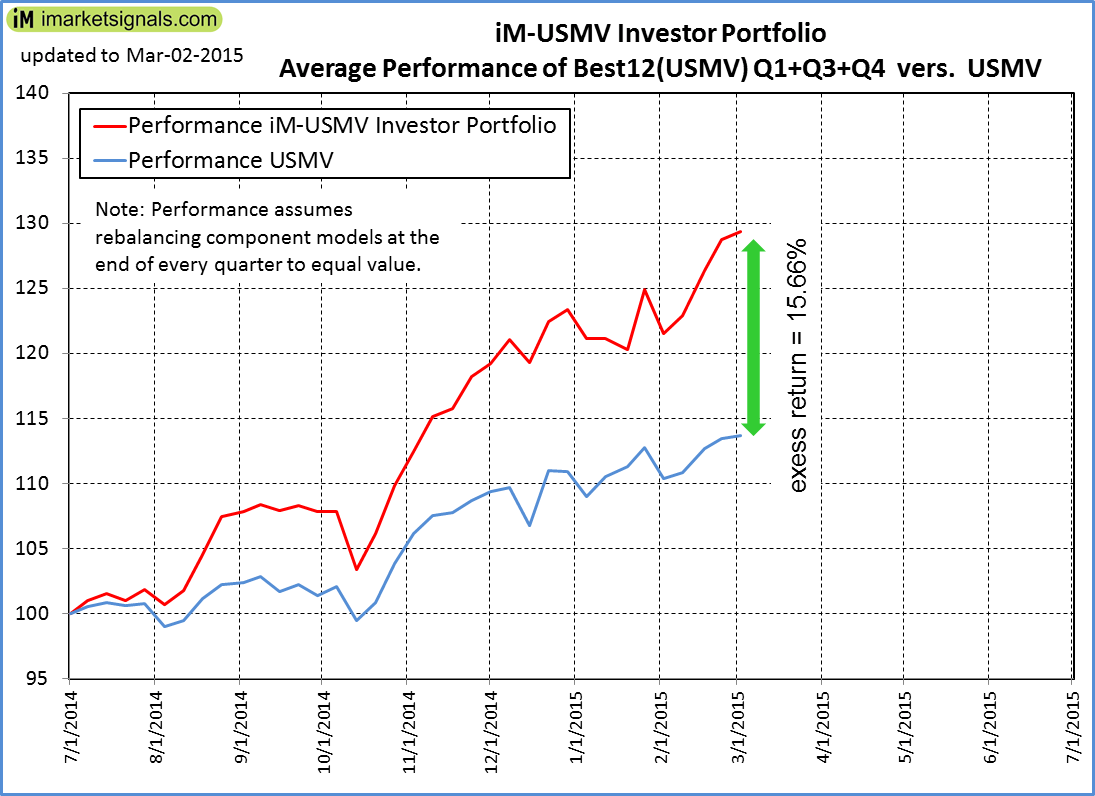

The performance from Jul-2014 to Mar-2015 is graphed in the charts below, showing that the iM-USMV Investor Portfolio has returned about 16% more than USMV, and 20% more than SPY so far.

Performance is calculated from the average of the weekly percentage changes of the component models assuming that models are rebalanced to equal weight periodically as follows:

- At the end of Q3 the investment in Best12(USMV)Q3 is reduced to 1/2 of the total and remaining funds are invest in Best12(USMV)Q4. The 2 models have been rebalanced to equal weight with half of the capital in each.

- At the end of Q4 the investment in each of the two models is reduced to 1/3 of the total and remaining funds are invest in Best12(USMV)Q1. The 3 models have been rebalanced to equal weight with a third of the capital in each.

- At the end of Q1 the investment in each of the three models is reduced to 1/4 of the total and remaining funds are invest in Best12(USMV)Q2. The 4 models have been rebalanced to equal weight with a quarter of the capital in each.

- At the end of Q2 the component models are rebalanced to equal weight, and further rebalancing occurs from then on every 3 months.

Following the model

The performance chart of the iM-USMV Investor Portfolio will be updated weekly and posted in the “Model Performance Tables” section at iM.

Back in July you indicated, “There is no need to follow all 4 models. One can just follow the July model.”

Certainly, if one only invests in one of the quarter models, the returns will be different from those above. However, did you find anything in your actual results so far that suggests that only investing in one of the quarter models will not work effectively?

Thanks!

So far all three of the launched quarterly displaced Best12(USMV) models have performed better than the ETF USMV or SPY. There is nothing to suggest that one has to follow all models to do better than benchmark USMV or SPY. We will launch the last model in April and it will be interesting to follow its performance relative to the benchmarks.

How are these models protected from a bear market?

They are not protected. There is no market timing built into those models. The idea is to see whether they perform better than ETF USMV. See our timing models MAC-US and Best(SPY-IEF) Market Timer for bear market protection.

Which of your models show a stop/loss provision?

I know you can’t necessarily endorse this – but… since there already is a 15% stop-loss provision from the high for Best-12 stocks, would a possible timing plan be: to only buy a replacement stock for one that’s stopped-out if MAC-US is in BUY territory. In other words, if MAC-US is in sell mode – hold off on buying a replacement until MAC-US goes into buy mode?

I’m trying to formulate a plan strictly for myself. I would appreciate any feedback – even though I know it’s not a recommendation from you guys. I just respect your opinions and would like to know what you think.

Agreed only replacing stocks when MAC-US is in buy mode would be a prudent strategy.

several of us are still confused and wish to follow this but Can you please just explain simply what is the best way to follow this system and what the difference is between the TRADER portfolio here and the 4 combined qtrly portfolios. Thanks

The Trader is rebalanced every 2 weeks and has 12 positions. The Trader has Overall Winners (40/54) 74.07% since July 2014 – 54 trades including the first 12 purchases at inception. So there were 42 additional trades, one has to trade quite often.

The four quarterly displaced Investor models are only rebalanced every 12 months. Therefore one would have to trade about every 3 months if one followed all the 4 Investor models and one would have about 30 positions.

The hypothesis is that the 4 Investor models combined should perform better than the underlying ETF USMV. So far performance is significantly better, but we have only been invested since July 2014. Apart from the 48 initial purchases there have only been 6 trades for the combined models. So trading is infrequent.

it would be helpful to instill more confidence by backtesting to the 2000 tech wreck recession and 2008 Great Recession for your 12 stk.investor stategy.

The USMV models cannot be backtested from 2000, because the ETF USMV inception date was Oct-2011, and also because the historic holdings are not published. We have records of the holdings since Mar-2014 (when we designed the models) and we record them quarterly from then onward.

Is there something about the USMV Investor quarterly model that you can keep and put into a single model? They are obviously some of your top performers. Perhaps the basis of USMV Trader is the same. If so, I wonder why it lags the other?

The USMV Investor models’ algorithm is the same as for the USMV Trader, except that the Investor models hold their stocks for at least one year unless a position loses more than 15% from a recent high.

It would appear that trading frequently is not as efficient as holding on to good stocks. Also the Investor models profits would be taxed at a lower rate.

If following one model – it is my understanding that the rebalance is to take place once a year? I see trades occurring each month?

based on the data – these are great portfolios – what am is missing regarding the trade frequency

or if other know please elaborate

thanks

i could be totally wrong, but i think that the investor models hold a position for a minimum of one year. so transactions can be made anytime after that year is up. probably more to it than that though

One can expect to have quite a few trades at the beginning of each quarter. Other transactions are caused when a sale occurs when a position loses more than 15% from a recent high.

is there a way to get updates on trades that the model makes? is there an email notification for example?

Currently there is no email service for the Investor models because trading is so infrequent. However, all recent trades are listed in the weekly performance updates, usually published on Tuesday.

georg,

Where does one go to see investments in the USMC tax efficient models?

Thank You,

Mark

Georg/Anton – a couple of questions about the Best12 USMV models results:

1. For each of the Investor and Trader model results, the max drawdowns are consistent with that of SPY and considerably higher than the USMV population from which the model is selected. If max drawdown represents a proxy for volatility, are you able to explain why the model ranking produces such a result?

2. Is there an explanation why the Trader model has not performed better than the Investor models in terms of both return and max drawdown?