|

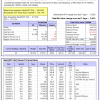

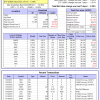

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 14 days, and showing a 2.69% return to 12/14/2015. Over the previous week the market value of Best(SPY-SH) gained 2.69% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $440,492 which includes -$2,391 cash and excludes $14,503 spent on fees and slippage. | |

| The iM-Combo3 model currently holds SH, SSO, and XLB, so far held for an average period of 21 days, and showing a -2.28% return to 12/14/2015. Over the previous week the market value of iM-Combo3 gained -2.02% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $131,571 which includes -$888 cash and excludes $2,121 spent on fees and slippage. | |

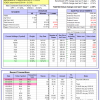

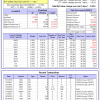

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 9 stocks, 3 of them winners, so far held for an average period of 151 days, and showing a 2.25% return to 12/14/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 2.71% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $436,617 which includes $209,210 cash and excludes $5,620 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 5 of them winners, so far held for an average period of 157 days, and showing a 0.45% return to 12/14/2015. Since inception, on 7/1/2014, the model gained 23.40% while the benchmark SPY gained 6.20% and the ETF VDIGX gained 8.51% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -3.35% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $123,398 which includes $45 cash and excludes $757 spent on fees and slippage. | |

| The iM-BESTOGA-3 model currently holds 3 stocks, 3 of them winners, so far held for an average period of 487 days, and showing a 37.71% return to 12/14/2015. Over the previous week the market value of iM-BESTOGA-3 gained -1.99% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $180,838 which includes $14,741 cash and excludes $805 spent on fees and slippage. | |

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 8 stocks, 1 of them winners, so far held for an average period of 53 days, and showing a -8.68% return to 12/14/2015. Over the previous week the market value of iM-Best3x4 gained -0.33% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $99,302 which includes $183 cash and excludes $651 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 5 stocks, 1 of them winners, so far held for an average period of 62 days, and showing a -3.21% return to 12/14/2015. Over the previous week the market value of iM-Best2x4 gained 0.50% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $96,053 which includes $1,040 cash and excludes $438 spent on fees and slippage. | |

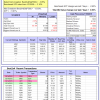

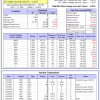

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 6 of them winners, so far held for an average period of 105 days, and showing a -0.38% return to 12/14/2015. Since inception, on 7/1/2014, the model gained 26.43% while the benchmark SPY gained 6.20% and the ETF USMV gained 14.07% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.78% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $126,426 which includes $200 cash and excludes $1,448 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 8 of them winners, so far held for an average period of 254 days, and showing a 1.34% return to 12/14/2015. Since inception, on 1/5/2015, the model gained 3.84% while the benchmark SPY gained 2.06% and the ETF USMV gained 4.76% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -3.28% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $103,842 which includes $201 cash and excludes $243 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 198 days, and showing a -8.88% return to 12/14/2015. Since inception, on 3/31/2015, the model gained -1.49% while the benchmark SPY gained -1.58% and the ETF USMV gained 1.18% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -2.83% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $98,505 which includes $101 cash and excludes $166 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 5 of them winners, so far held for an average period of 106 days, and showing a 1.18% return to 12/14/2015. Since inception, on 7/1/2014, the model gained 16.65% while the benchmark SPY gained 6.20% and the ETF USMV gained 14.07% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -2.83% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $116,646 which includes $317 cash and excludes $493 spent on fees and slippage. | |

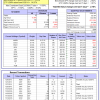

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 8 of them winners, so far held for an average period of 92 days, and showing a -0.47% return to 12/14/2015. Since inception, on 9/30/2014, the model gained 10.69% while the benchmark SPY gained 4.79% and the ETF USMV gained 12.50% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -3.70% at a time when SPY gained -2.62%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $110,693 which includes $122 cash and excludes $372 spent on fees and slippage. | |

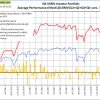

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 16.14% over SPY. (see iM-USMV Investor Portfolio) | |

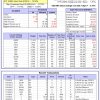

| The iM-Best(Short) model currently holds 0position(s), valued $0 . Over the previous week the market value of iM-Best(Short) gained 0.79% at a time when SPY gained -2.62%. Over the period 1/2/2009 to 12/14/2015 the starting capital of $100,000 would have grown to $104,410 which includes $104,410 cash and excludes $21,559 spent on fees and slippage. |

iM-Best Reports – 12/14/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.