|

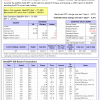

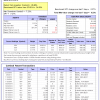

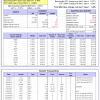

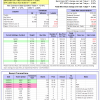

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 70 days, and showing a 2.55% return to 3/2/2015. Over the previous week the market value of Best(SPY-SH) gained 0.37% at a time when SPY gained 0.37% A starting capital of $100,000 at inception on 1/2/2009 would have grown to $371,581 which includes $174 cash and excludes $12,136 spent on fees and slippage. |

|

|

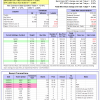

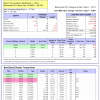

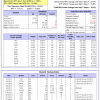

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 168 days, and showing a 13.51% return to 3/2/2015. Over the previous week the market value of iM-Combo3 gained 0.53% at a time when SPY gained 0.37% A starting capital of $100,000 at inception on 2/3/2014 would have grown to $126,883 which includes $1.545 in cash and excludes $1025 in fees and slippage. |

|

|

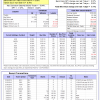

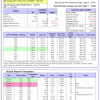

The iM-Best(Short) portfolio currently has 2 short positions. Over the previous week the market value of Best(Short) gained 0.96% at a time when SPY gained 0.37% Over the period 1/2/2009 to 3/2/2015 the starting capital of $100,000 would have grown to $105,454 which is net of $17,289 fees and slippage. |

|

|

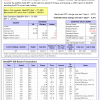

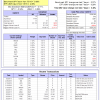

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 9 of them winners, so far held for an average period of 36 days, and showing combined 3.91% average return to 3/2/2015. Over the previous week the market value of iM-Best10(S&P 1500) gained -0.40% at a time when SPY gained 0.37% A starting capital of $100,000 at inception of 1/2/2009 would have grown to $859,137 which includes $13 cash and excludes $62,143 spent on fees and slippage. |

|

|

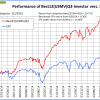

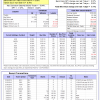

The iM-Best12(USMV)Q1-Investor currently holds 12 stocks, 11 of them winners, so far held for an average period of 51 days, and showing combined 7.10% average return to 3/2/2015. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.48% at a time when SPY gained 0.37% A starting capital of $100,000 at inception of 1/15/2015 would have grown to $107,575 which includes $221 cash and excludes $134 spent on fees and slippage. |

|

|

The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 227 days and showing combined 30.48% average return to 3/2/2015. Since inception, on 6/30/2014, the model gained 29.71% while the benchmark SPY gained 9.36% and the ETF USMV gained 13.66% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained 1.00% at a time when SPY gained 0.37% A starting capital of $100,000 at inception on 6/30/2014 has grown to $129,711, which includes $64 cash and $128 for fees and slippage. |

|

|

The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 134 days, and showing combined 19.74% average return to 3/2/2015. Since inception, on 9/29/2014, the model gained 18.68% while the benchmark SPY gained 7.90% and the ETF USMV gained 12.09% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 0.81% at a time when SPY gained 0.37% A starting capital of $100,000 at inception on 9/29/2014 has grown to $118,681 which includes $7 cash and $131 for fees and slippage. |

|

|

Average Performance of iM-Best12(USMV)Q1+Q3+Q4-Investor resulted in an excess return of 20.1% over SPY. (see iM-USMV Investor Portfolio) |

,

|

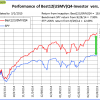

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 10 of them winners, so far held for an average period of 100 days, and showing combined 7.47% average return to 3/2/2015. Since inception, on 6/30/2014, the model gained 28.09% while the benchmark SPY gained 9.36% and the ETF USMV gained 13.66% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.30% at a time when SPY gained 0.37% A starting capital of $100,000 at inception on 6/30/2014 has grown to $128,091 which includes $53 cash and $791 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 9 of them winners, so far held for an average period of 181 days, and showing combined 10.72% average return to 3/2/2015. Since inception, on 6/30/2014, the model gained 17.05% while the benchmark SPY gained 9.36% and the VDIGX gained 9.76% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained 0.11% at a time when SPY gained 0.37% A starting capital of $100,000 at inception on 6/30/2014 has grown to $117,054 which includes $237 cash and $302 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.